In this Edition:

Shutdown Stalls Data but Markets Stay Firm

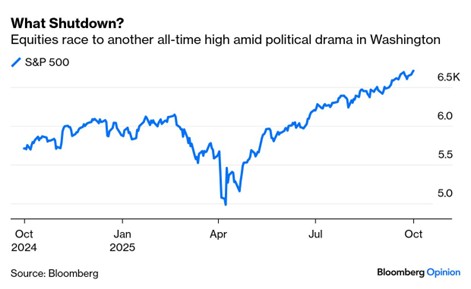

The U.S. government shutdown delayed key data releases, but equities advanced as investors looked past short-term disruptions.

Inflation Holds Steady as Stocks Rally

Eurozone inflation remained stable while European markets climbed to record highs on optimism over lower U.S. rates.

Japan Steady, China’s Growth Softens

Asian markets gained despite mixed economic signals from Japan and China.

Global Equity Markets Rally Across Regions

Global stock markets rose last week, with strong gains in the U.S., Europe, and Asia despite the U.S. government shutdown and regional holidays.

Manufacturing Expands but Job Losses Persist

Manufacturing rebounded in September on stronger local demand, though formal employment continued to weaken.

Market Moves and Chart of the Week

Shutdown Stalls Data but Markets Stay Firm

The U.S. federal government shut down on October 1 after Congress failed to pass a funding bill. The shutdown has furloughed hundreds of thousands of federal workers, halted non-essential services, and delayed key data releases. Among the most notable was the September nonfarm payrolls report from the Bureau of Labor Statistics, which did not go ahead as scheduled. If the shutdown persists, other critical releases (such as the September CPI due October 15) may also be delayed.

In the absence of the payrolls data, markets turned to alternative indicators, with ADP reporting a 32,000 job loss in September versus expectations for a 51,000 gain. While this headline weakness added to conviction around further Fed rate cuts, much of the drop reflected ADP’s benchmarking to revised government data rather than a fundamental deterioration in labour market conditions.

Inflation Holds Steady as Stocks Rally

Euro area headline inflation ticked higher to 2.2% year-on-year in September from 2.0% in August, driven by firmer services prices and a slower decline in energy costs. Core inflation, excluding food and energy, was unchanged at 2.3%. In a keynote address at the Bank of Finland, ECB President Christine Lagarde noted that inflation risks appear broadly contained in both directions, emphasising that with policy rates at 2%, the ECB is well positioned to respond should risks evolve or new shocks emerge.

On the labour front, the unemployment rate in the bloc edged up to 6.3% in August from July’s record low of 6.2%. Spain, France, and Italy recorded the highest unemployment rates, while Germany and the Netherlands posted the lowest. On a year-over-year basis, unemployment was unchanged at 6.3%.

Japan Steady, China’s Growth Softens

The Bank of Japan (BoJ) signalled that it remains on a gradual tightening path but provided limited guidance on the timing of its next rate hike. Governor Kazuo Ueda noted that rates were left unchanged at the September meeting to maintain accommodative conditions amid U.S. tariff volatility. While the tariffs have weighed on exporters’ earnings, there are no signs of spillovers to the broader economy.

China’s official manufacturing PMI edged up to 49.8 in September from 49.4 in August, while the non-manufacturing PMI, covering construction and services activity, slipped to 50.0 from 50.3. Readings above 50 signal expansion, while those below 50 indicate contraction. Despite the manufacturing PMI slightly beating the median forecast, it marked the sixth consecutive month of contraction in factory activity. Both indicators suggest that economic weakness persisted into Q3, following stronger growth in the first half of the year.

Global Equity Markets Rally Across Regions

Global equities posted broad gains despite the U.S. government shutdown that began on Thursday. In the U.S., the Nasdaq Composite led the gains, rising 1.32% last week, while the Dow Jones and S&P 500 increased 1.10% and 1.09%, respectively.

European markets also advanced, with the STOXX Europe 50 climbing 2.76% in local currency to record levels, supported by strength in technology stocks and expectations of lower U.S. borrowing costs. The UK’s FTSE 100 gained 2.22% over last week.

In Asia, Japan’s Nikkei 225 rose 0.91%. Mainland Chinese equities also advanced in a holiday-shortened week, with the Shanghai Composite up 1.43% through Tuesday, September 30, before markets closed for the Golden Week holiday from October 1 to 8. In Hong Kong, the Hang Seng Index gained 3.82%, despite the market being closed on Wednesday for National Day.

Manufacturing Expands but Job Losses Persist

South African manufacturing sentiment improved in September, supported by strong domestic demand, according to the latest PMI survey. The seasonally adjusted Absa PMI rose to 52.2 points from 49.5 in August, marking only the second time this year the index has indicated expansion. The report highlighted that gains were driven by local demand, while global trade challenges, including U.S. tariffs and port disruptions, continued to weigh on the sector.

Formal employment in South Africa came under continued pressure in Q2 2025, according to Stats SA’s Quarterly Employment Survey (QES). The survey, which tracks formal jobs in the country excluding agriculture, forestry, fishing, and private households, showed job losses across key sectors, notably community services, trade, and manufacturing. The QES differs from the broader Quarterly Labour Force Survey (QLFS), which captures informal and domestic work as well as unpaid family labour. The data highlight ongoing strain in the formal labour market.

South African markets mirrored global trends, posting gains over last week. The JSE All-Share Index rose 2.88%, supported by broad-based sector gains. Industrials led the advance with a 4.12% return, while other sectors also made meaningful contributions. The rand strengthened 0.21% against the U.S. dollar, closing at R17.21/USD.