In this Edition:

US equities rotate as technology leadership pauses:

Technology weakness and mixed data drove a rotation toward cyclical sectors.

European markets steady as easing inflation offsets mixed growth:

Markets edged higher as rate stability offset uneven economic signals.

Asia diverges as China demand concerns persist and Japan rallies:

Weak Chinese demand contrasted with the strength in Japan.

South Africa steady as sector performance diverges and China ties deepen:

Stable markets reflected sector divergence and strengthening China ties.

Global markets delivered a mixed performance last week as investors navigated a combination of economic data, shifting policy expectations and evolving sector leadership. While overall index movements were relatively contained, underlying market dynamics pointed to a continued rotation away from narrow technology leadership toward more cyclical and value-oriented areas.

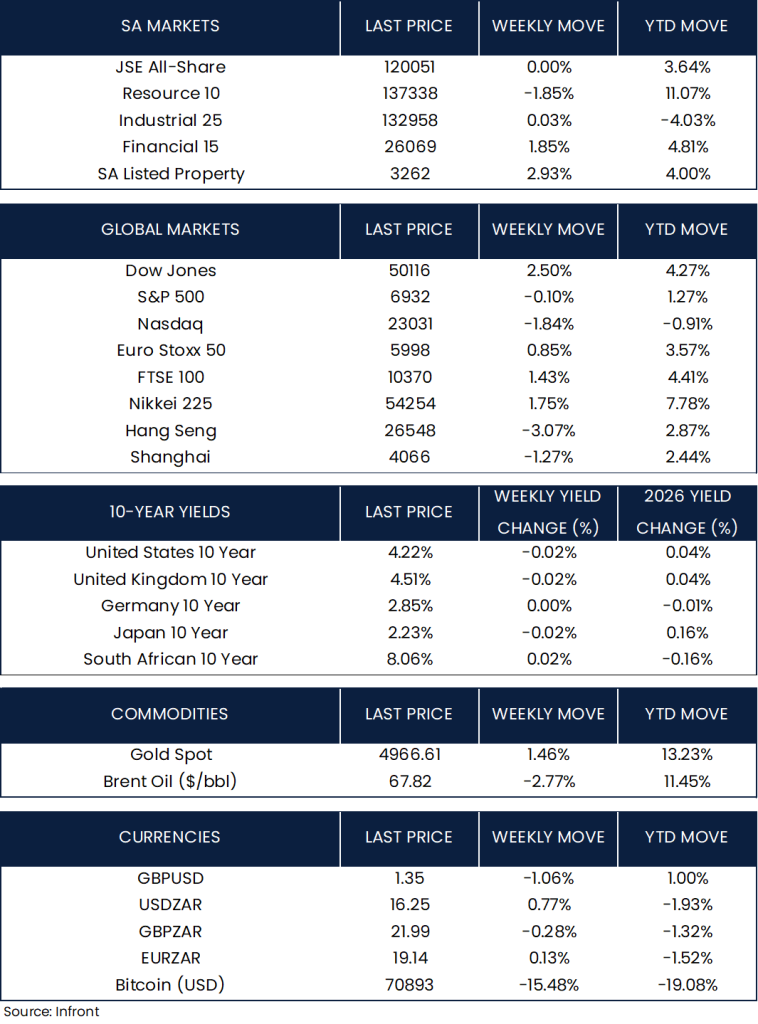

MARKET MOVES OF THE WEEK

Source: Infront (08 February 2026)

MARKET MOVES OF THE WEEK

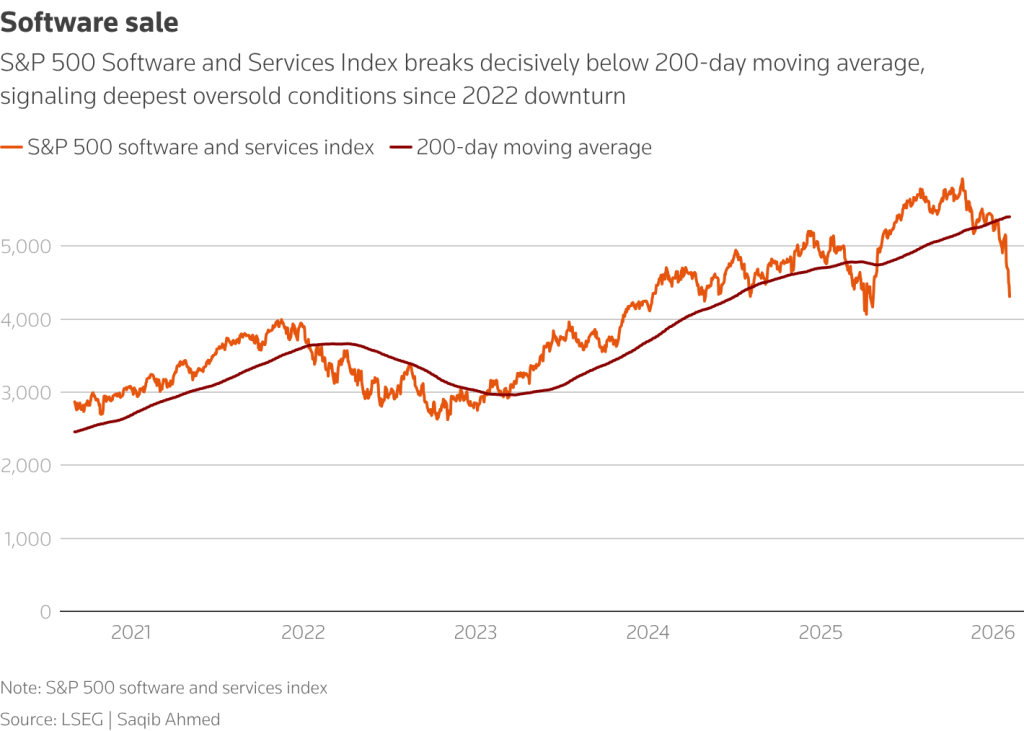

Source: LSEG | Saqib Ahmed (08 February 2026)

Software stocks have come under significant pressure, with the S&P 500 Software & Services Index falling decisively below its 200-day moving average, its weakest technical position since the 2022 downturn. The move reflects a broader rotation away from high-growth technology shares and toward more cyclical and value-oriented sectors, a theme that shaped global markets this week.

US Equities Rotate as Technology Leadership Pauses:

In the United States, equity markets ended last week divided. The Nasdaq declined 1.84%, reflecting pressure on large-cap technology shares, while the S&P 500 was broadly unchanged at -0.10%. In contrast, the Dow Jones Industrial Average rose 2.50%, supported by gains in more traditional and cyclical sectors. The week highlighted a shift in investor positioning, as concerns around the pace of artificial intelligence investment and its impact on corporate profitability weighed on high-growth companies that have driven market returns in recent years. At the same time, investors rotated into areas of the market that have lagged, including financials and industrials, which benefited from improving economic expectations.

Economic data releases added to the cautious tone. Labour market indicators were softer than anticipated, with slower private job creation, a decline in job openings to their lowest level since 2020 and a notable rise in layoffs. Despite this, parts of the real economy showed resilience. Manufacturing activity returned to expansion territory for the first time in a year, supported by stronger new orders, while services activity remained stable and continued to expand. In fixed income markets, U.S. Treasury yields edged lower, supporting bond returns, as investors positioned more defensively amid mixed economic signals.

European Markets Steady as Easing Inflation Offsets Mixed Growth:

Across the United Kingdom and Europe, markets delivered a steadier performance. The Euro Stoxx 50 gained 0.85% and the FTSE 100 rose 1.43% over the last week, supported by easing inflation and a relatively resilient economic backdrop. Policymakers maintained a cautious stance, with the European Central Bank holding rates unchanged and signalling that inflation is gradually moving back toward its 2% target. The Bank of England also left policy rates on hold but indicated that the path toward rate cuts may be approaching, particularly if inflation continues to moderate. Economic data was mixed, with retail activity softening slightly, although broader trends suggest household spending is stabilising. Overall, sentiment across the region remained constructive as investors balanced slowing inflation with steady growth.

Asia Diverges as China Demand Concerns Persist and Japan Rallies:

Asian markets showed diverging trends. In China, equities struggled, with the Shanghai Composite falling 1.27% and the Hang Seng declining 3.07%. Weakness in technology shares and ongoing concerns about domestic demand continued to weigh on investor sentiment. Economic indicators provided a mixed picture. Private-sector surveys suggested modest improvements in activity, particularly in manufacturing and services, supported by export demand. However, official data pointed to slower overall momentum, highlighting the challenges China faces in reviving domestic consumption. Expectations remain that policymakers will introduce further measures to support growth in the months ahead.

In Japan, equity markets moved higher, with the Nikkei 225 rising 1.75% for the week. Investor optimism was supported by expectations of continued fiscal support and political stability ahead of the country’s upcoming election. A weaker yen provided additional support for export-oriented companies, although it also underscores the delicate balance policymakers face in managing inflation and financial stability. Economic data showed that household spending declined, reflecting the ongoing pressure on consumers from rising prices. Bond yields remain elevated, reinforcing concerns around Japan’s fiscal position and the long-term sustainability of its debt levels.

South Africa Steady as Sector Performance Diverges and China Ties Deepen:

South African markets were relatively stable, with the JSE All Share finishing the week unchanged. Performance across sectors was mixed, with financials and listed property posting gains while resources declined amid commodity volatility, and industrials were largely flat. The domestic bond market was steady, with the 10-year government yield closing around 8.06%.

On the policy front, South Africa moved to deepen its economic relationship with China through the signing of a new framework agreement aimed at expanding trade and investment ties. The agreement is expected to improve access for South African exports into Chinese markets while encouraging further Chinese investment across sectors such as mining, agriculture, renewable energy and manufacturing. Although still in its early stages, the initiative signals growing economic cooperation and could support longer-term growth and employment prospects.

Overall, last week reinforced a key theme shaping global markets: leadership is broadening. After an extended period dominated by large-cap technology, investors are increasingly allocating toward value-oriented sectors, cyclical industries and regions outside the United States. Economic data remains mixed, with labour markets softening in some areas while manufacturing stabilises and inflation continues to ease. For long-term investors, this environment supports the case for diversification across geographies, asset classes and sectors, as markets adjust to shifting growth expectations and evolving monetary policy paths.

The information contained in this recording/presentation is for general information purposes only and should not be construed as, nor does it constitute financial, tax, legal, investment or any other advice. Carrick does not guarantee the suitability or potential value of any products or investments discussed herein. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the information, products, services, or any other content contained in this recording for any purpose. Carrick accepts no responsibility for the suitability or accuracy of the information or for any errors or omissions that may occur. Therefore, any reliance you place on such information is strictly at your own risk. This material is provided for general information purposes only and is not personal advice to anyone to invest in any fund or product. Information taken from trade and other sources is believed to be reliable, although Carrick does not represent this as accurate or complete and it shouldn’t be relied upon as such. All material, content, and information provided by Carrick is the intellectual property of Carrick Group and its affiliates, unless otherwise stated. No part of this material may be copied, reproduced, distributed, published, or used for any commercial purpose without Carrick’s prior written consent, and is provided solely for non-commercial use. Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting an investment.