In this Edition:

U.S. confidence slides as Fed holds rates and inflation pressures re-emerge:

U.S. sentiment weakened as falling consumer confidence, renewed inflation pressure, and policy uncertainty weighed on markets.

Europe’s growth improves as trade diplomacy and mixed markets shape outlook:

European growth outperformed expectations, supported by stronger GDP data and renewed UK–China engagement, even as equity markets delivered mixed results.

Asian markets are mixed as Japan weakens and Hong Kong rebounds:

Asian markets were mixed, with declines in Japan and China offset by strong gains in Hong Kong amid uneven regional economic signals.

Global equities mixed as US tech slips and UK shares outperform:

Equity performance was uneven, with mixed outcomes across US indices and stronger relative performance in the UK compared with flat European markets.

South Africa holds rates as rand volatility and sector divergence persist:

South Africa maintained a cautious monetary stance as mixed equity performance and currency volatility reflected ongoing global and domestic uncertainties.

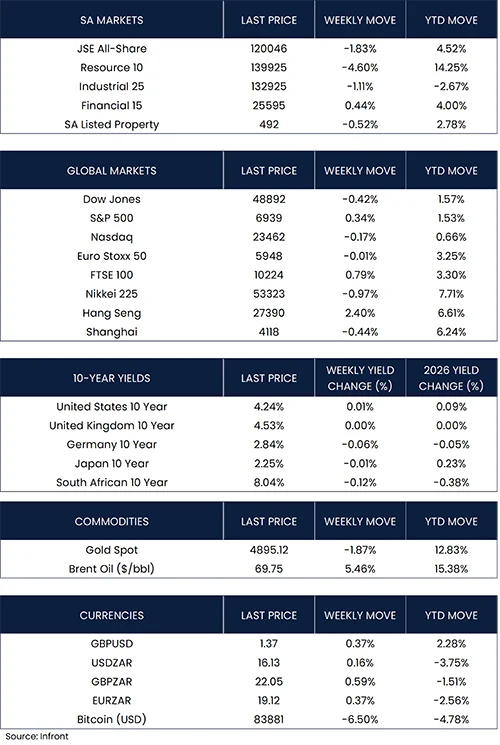

Market Moves and Chart of the Week

U.S. confidence slides as Fed holds rates and inflation pressures re-emerge:

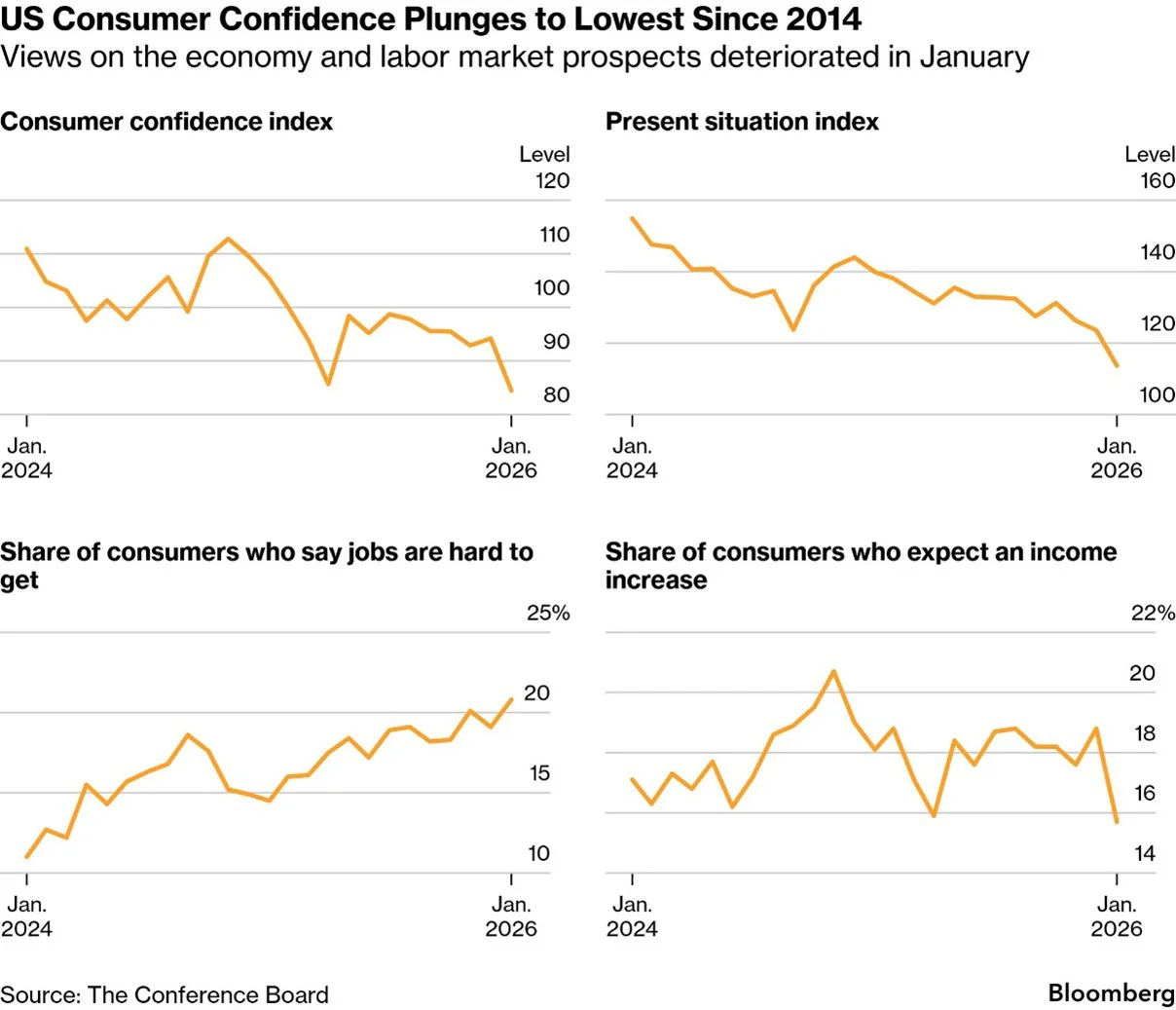

After three consecutive cuts, the Federal Reserve left the fed funds rate unchanged at 3.50%–3.75%, in line with expectations, in a 10–2 vote, with two officials favouring a 25-basis-point reduction. The accompanying policy statement struck a more constructive tone on growth, noting activity has been expanding at a solid pace, while inflation remains somewhat elevated and labour market conditions are showing signs of stabilisation. At the press conference, Chair Jerome Powell said rates did not appear “significantly restrictive” given economic momentum and reiterated that decisions would be taken on a meeting-by-meeting basis. On Friday morning, U.S. President Donald Trump nominated former Federal Reserve governor Kevin Warsh to succeed Jerome Powell as Fed chair when Powell’s term expires in mid-May, subject to Senate confirmation. Warsh served from 2006 to 2011 and was a finalist for the role in 2017. He is viewed as a pragmatist who argues the Fed has strayed from its mandate and that its balance sheet is excessive, with his nomination seen as largely easing recent concerns over central bank independence. The announcement sparked a rebound in the dollar, weighing on precious metals and pushing gold and silver lower after investors had piled into the sector. U.S. producer prices climbed by the most in five months in December, partly reflecting pass-through from import tariffs and pointing to renewed inflation pressures. The figures, published by the United States Department of Labor, came in above expectations and were driven mainly by higher services prices, especially trade margins, hotel accommodation and airfares. Goods prices were unchanged, while the data reinforced the likelihood that the Federal Reserve keeps interest rates steady for now. Separately, the Conference Board’s consumer confidence index fell sharply in January to its lowest level since May 2014, undershooting expectations as households reported weaker views on the economy and labour market.

Europe’s growth improves as trade diplomacy and mixed markets shape outlook:

The eurozone economy expanded 1.5% in 2025, up from 0.9% in 2024 and ahead of the European Commission’s 1.3% forecast, as stronger investment, household spending and exports offset political and economic uncertainty. Fourth-quarter GDP rose 0.3% quarter on quarter, slightly above expectations and in line with the prior pace, with faster growth in Germany, Spain and Italy helping to counter sluggish momentum in France. British Prime Minister Keir Starmer visited Beijing last week to reset relations between the United Kingdom and China after years of strain linked partly to Hong Kong. After talks with President Xi Jinping, Starmer said the UK was entering a new, “sophisticated” relationship, with the two sides agreeing to study greater market access in business and financial services, cut Chinese whisky tariffs from 10% to 5%, and introduce visa-free travel for Britons. In response, U.S. President Donald Trump later warned Starmer that closer UK–China business ties would be “very dangerous.”

Global equities mixed as US tech slips and UK shares outperform:

The S&P 500 Index edged slightly higher to finish the last week up 0.34%, while the Nasdaq Composite and the Dow Jones Industrial Average ended marginally lower, down 0.17% and 0.42% respectively. In Europe, the STOXX Europe 50 Index was flat at -0.01%, while the UK’s FTSE 100 Index gained 0.79%.

Asian markets are mixed as Japan weakens and Hong Kong rebounds:

In Asia, markets were mixed. Japan’s Nikkei 225 Index fell 0.97%, while mainland China’s Shanghai Composite Index slipped 0.44%. Meanwhile, Hong Kong’s Hang Seng Index gained 2.40%.

South Africa holds rates as rand volatility and sector divergence persist:

The South African Reserve Bank held its repo rate at 6.75% at its first policy meeting of 2026, with the Monetary Policy Committee opting for caution amid ongoing global and domestic uncertainty and inflation expectations still above the 3% target. While two members favoured a 25-basis-point cut, the majority preferred to maintain the current stance, and the Bank’s projections continue to anticipate gradual easing as inflation trends lower. Governor Lesetja Kganyago noted that inflation is contained but services price pressures persist, and decisions will remain data dependent as the economy navigates risks including currency and administered price developments. Similar to global peers, the JSE All-Share Index fell 1.83% over the last week, dragged lower by a 4.60% drop in resources, while industrials (-1.11%) and SA property (-0.52%) also detracted from returns. Financials were the only sector to record gains, rising 0.44%. In currency markets, the rand strengthened earlier last week to around R16 per dollar, its firmest level since mid-2022, on the back of elevated gold prices, before ending Friday at R16.13 after a rebound in the dollar, leaving it 0.13% weaker over the week.

Chart of the Week

U.S. consumer confidence slumped in January to its lowest level in 12 years, as households grew more concerned about the economy, inflation and labour market conditions. The Conference Board’s index fell to 84.5 from a revised 94.2, undershooting all forecasts in a Bloomberg survey of economists and marking the weakest reading since May 2014.

The information contained in this recording/presentation is for general information purposes only and should not be construed as, nor does it constitute financial, tax, legal, investment or any other advice. Carrick does not guarantee the suitability or potential value of any products or investments discussed herein. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the information, products, services, or any other content contained in this recording for any purpose. Carrick accepts no responsibility for the suitability or accuracy of the information or for any errors or omissions that may occur. Therefore, any reliance you place on such information is strictly at your own risk. This material is provided for general information purposes only and is not personal advice to anyone to invest in any fund or product. Information taken from trade and other sources is believed to be reliable, although Carrick does not represent this as accurate or complete and it shouldn’t be relied upon as such. All material, content, and information provided by Carrick is the intellectual property of Carrick Group and its affiliates, unless otherwise stated. No part of this material may be copied, reproduced, distributed, published, or used for any commercial purpose without Carrick’s prior written consent, and is provided solely for non-commercial use. Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting an investment.