In this Edition:

Soft landing signals support US markets despite mixed data:

US data showed easing inflation and moderating activity, while equity markets ended the week mixed amid year-end positioning.

Easing inflation and steady policy underpin European assets:

UK inflation surprised to the downside and the ECB held rates steady, supporting modest gains in European equity markets.

Asia pressured as Japan tightens and China growth slows:

Japan raised rates to a multi-decade high while weak Chinese consumption and equity declines weighed on regional sentiment.

Lower inflation and stronger rand support South African markets:

South African inflation moderated, producer prices remained contained, and equities advanced alongside a firmer rand.

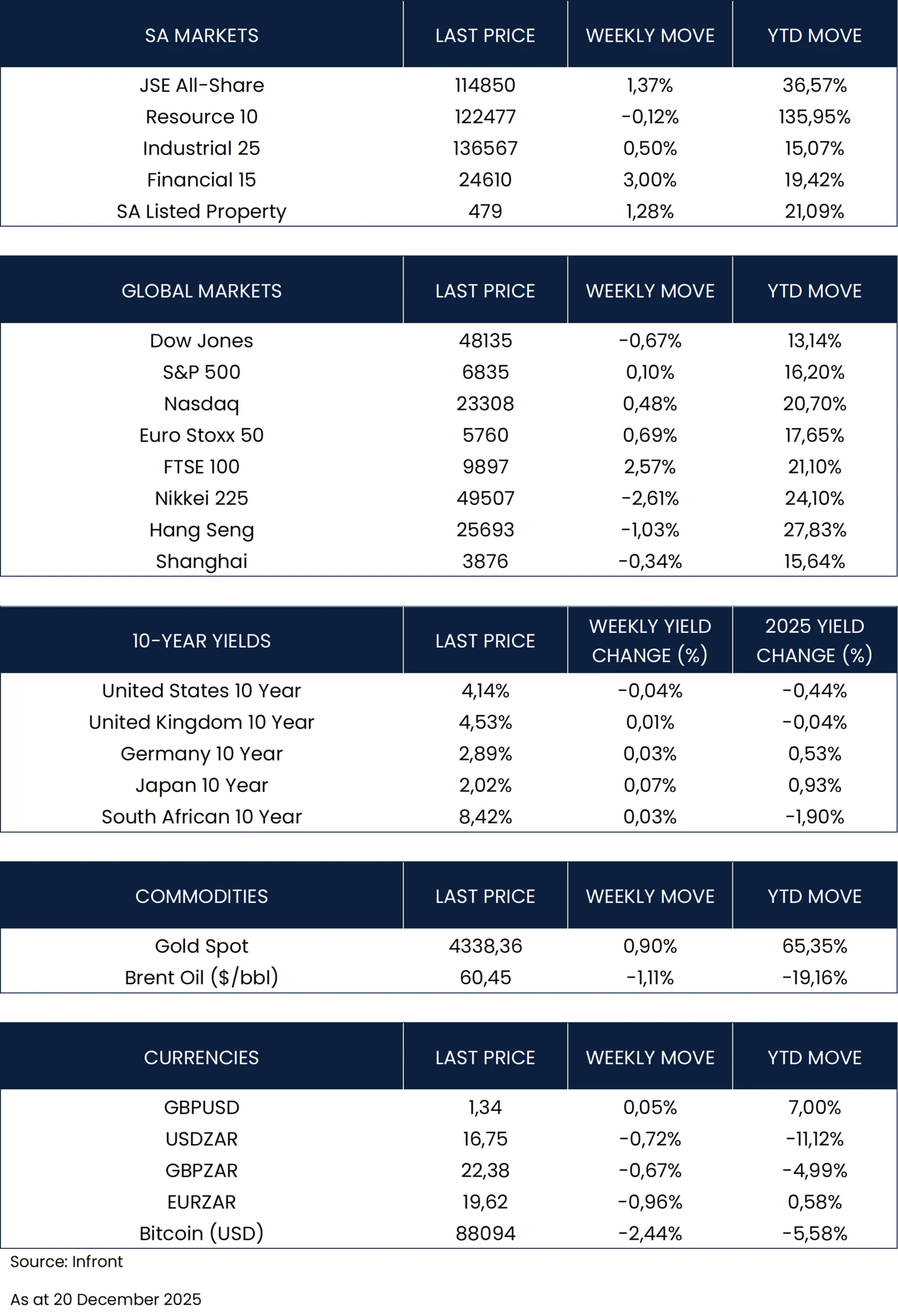

Market Moves and Chart of the Week

Soft landing signals support US markets despite mixed data

The U.S. Bureau of Labor Statistics reported that nonfarm payrolls rose by 64,000 in November, beating expectations and rebounding from the 105,000 jobs lost in October due to the federal government shutdown. Job gains were led by health care and construction, while the unemployment rate edged up to 4.6%, its highest level in over four years.

US consumer inflation eased more than expected in November, with headline CPI rising 2.7% year on year, down from 3.0% in September and below market expectations. Core inflation, which excludes food and energy, slowed to 2.6% year on year, the softest underlying inflation outcome since early 2021. The Bureau of Labor Statistics noted that data collection was affected by the recent federal government shutdown, while inflation in essential categories such as food and electricity remained relatively elevated.

Meanwhile, S&P Global’s Flash US Composite PMI pointed to a moderation in business activity in December, falling to 53.0 from 54.2 in the previous month. While the index remained in expansionary territory, the reading was the lowest in six months, reflecting slower growth across both manufacturing and services.

U.S. equity markets ended the final full trading week of the year mixed, as the Dow Jones Industrial Average fell 0.67%, the S&P 500 finished broadly flat, and the Nasdaq Composite rose 0.48%.

Easing inflation and steady policy underpin European assets

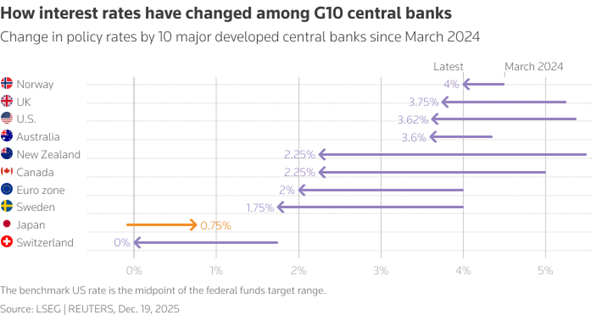

UK inflation fell more than expected in November, with headline CPI easing to 3.2% year on year from 3.6% in October, marking its lowest level in eight months. The Office for National Statistics noted that the decline was driven in part by lower prices for certain food items, including cakes, biscuits and breakfast cereals. Following the softer inflation outcome, the Bank of England voted to cut interest rates by 25 basis points to 3.75%, taking the base rate to its lowest level since February 2023.

The European Central Bank (ECB) left the deposit rate unchanged at 2.0% for a fourth consecutive meeting. President Christine Lagarde said policy remains “in a good place,” while reiterating a data-dependent, meeting-by-meeting approach amid ongoing uncertainty. The ECB also marginally lifted its growth outlook, forecasting GDP growth of 1.4% in 2025, 1.2% in 2026, and 1.4% in 2027–28.

European equities posted modest gains in local currency terms, supported by signs of steady economic growth and a more accommodative monetary policy backdrop. The STOXX Europe 50 Index advanced 0.69%, while the UK’s FTSE 100 gained 2.57%.

Asia pressured as Japan tightens and China growth slows

The Bank of Japan delivered a widely expected 25 basis point increase in its benchmark interest rate, lifting it from 0.50% to 0.75%, the highest level since 1995. The decision was unanimous and reflected growing confidence that the central bank’s economic outlook will be realised.

In China, data from the National Bureau of Statistics showed that retail sales rose 1.3% year on year in November, the slowest pace since the pandemic, highlighting ongoing weakness in consumption despite government efforts to stimulate demand. Fixed asset investment fell 2.6% over the first 11 months of the year, missing expectations, while industrial output rose 4.8% year on year, underscoring the economy’s continued reliance on exports. Earlier in December, Chinese leaders signalled that they are unlikely to materially ramp up stimulus next year, even as they reiterated support for growth.

Asian equities were weaker over the week. Japan’s Nikkei 225 fell 2.61%, pressured by losses in technology stocks amid valuation concerns and elevated spending on artificial intelligence. Chinese markets also declined, with the Shanghai Composite down 0.34% and Hong Kong’s Hang Seng Index falling 1.03%.

Lower inflation and stronger rand support South African markets

South African consumer inflation edged lower in November, with headline CPI slowing to 3.5% year on year from 3.6% in October. The moderation was supported by lower fuel prices and a firmer rand, according to Statistics South Africa (Stats SA). Core inflation, which excludes food, non-alcoholic beverages, fuel and electricity, edged slightly higher to 3.2% from 3.1% in October, indicating that underlying price pressures remain broadly stable.

Producer price inflation, which measures changes in the cost of goods before they reach consumers, was unchanged at 2.9% year on year in November, according to Stats SA. Electricity and water producer prices eased to 15.3% from 16.1%, while mining producer inflation rose to 19.9%. While recent readings point to contained inflation pressures, both producer and consumer inflation are expected to trend higher in the months ahead due to base effects.

The JSE All-Share Index advanced 1.37% over the week, supported by a strong 3.00% gain in the financial sector. The industrials and property sectors posted modest gains of 0.50% and 1.28%, respectively, while the resource sector marginally declined by 0.12%. Meanwhile, the rand strengthened modestly, appreciating 0.72% against the U.S. dollar to close at R16.75 on Friday.