In this Edition:

Softening tariff risk tempers volatility as resilient data underpin US growth

Political headlines drove short-lived volatility, but economic data continued to point to solid underlying expansion.

Fragile recovery signals emerge across the UK and Europe

Stabilising inflation and sentiment offer cautious optimism, though trade weakness and political risks persist.

Asia remains volatile amid political uncertainty and uneven growth

Japan faced fiscal and political volatility while China’s recovery remained fragile despite meeting growth targets.

Safe-haven demand lifts commodities amid geopolitical uncertainty

Gold surged to record highs on renewed risk aversion, while oil prices rose as geopolitical tensions and a softer dollar supported broader commodity strength.

Stronger rand and easing inflation support South African assets

Currency strength, contained inflation and firm commodities buoyed sentiment despite weak growth fundamentals.

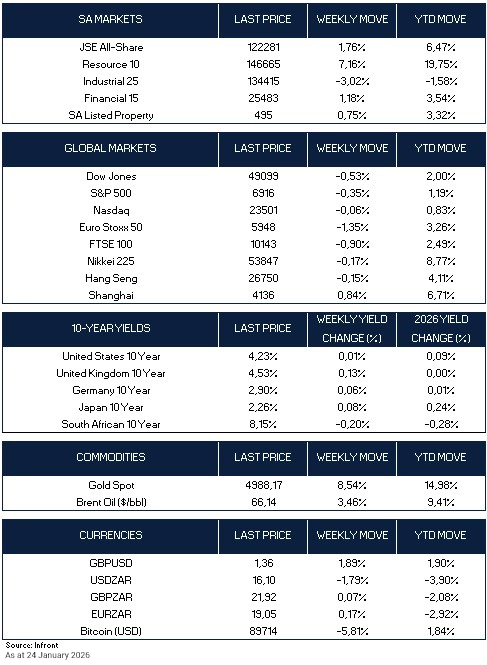

Market Moves and Chart of the Week

Softening tariff risk tempers volatility as resilient data underpin US growth

Global markets navigated another week shaped by geopolitical uncertainty and shifting investor sentiment, as renewed U.S. tariff threats briefly unsettled risk appetite before attention returned to economic data and corporate earnings. A fresh round of company earnings is testing whether the AI-driven profit cycle is broadening beyond a narrow group of technology leaders, while recent geopolitical developments underscored how quickly policy uncertainty can re-emerge and influence market confidence. Although volatility proved short-lived, the episode highlighted the persistent tension between political risk and economic fundamentals that continues to define the global investment landscape.

In the United States, markets were initially rattled by an escalation in tariff rhetoric linked to President Trump’s push to acquire Greenland, triggering a sharp risk-off reaction. U.S. equities declined, the dollar weakened, Treasury yields fell and gold surged to record highs, briefly reviving the “sell America” narrative that had emerged at times in 2025. Sentiment improved later in the last week after Trump softened his stance and signalled a potential framework for a deal, allowing markets to stabilise. Beneath the political headlines, economic data remained broadly resilient: real GDP growth was revised higher to an annualised 4.4% in the third quarter, core inflation held at 2.8% year-on-year, jobless claims remained near historically low levels and business activity indicators showed modest improvement. Together, these data suggest the U.S. economy continues to expand at a solid pace, even as political uncertainty injects episodic volatility.

Fragile recovery signals emerge across the UK and Europe

Across Europe, the macro backdrop showed tentative improvement but remained uneven, with stabilising inflation and improving business sentiment offset by persistent structural headwinds. Eurozone inflation rose 0.2% month-on-month in December, while survey data pointed to modest expansion and stronger forward-looking confidence, particularly in Germany. However, the region’s trade surplus narrowed sharply, highlighting the ongoing drag from weak external demand and elevated global uncertainty. Overall, the data suggest that while recession risks have eased, the recovery remains fragile and heavily dependent on the global trade cycle.

In the UK, the economic picture was similarly mixed. The unemployment rate held at a five-year high of 5.1% and wage growth continued to slow, signalling a gradual cooling in the labour market, while inflation surprised slightly to the upside in December. At the same time, retail sales rebounded and consumer confidence improved modestly, indicating that household spending remains resilient despite persistent cost-of-living pressures. Against this backdrop, renewed progress on U.S.–EU trade relations helped stabilise sentiment, although ongoing political and trade tensions continue to constrain Europe’s growth outlook and leave the region highly sensitive to global policy and geopolitical developments.

Asia remains volatile amid political uncertainty and uneven growth

In Asia, Japan experienced heightened volatility as political uncertainty and fiscal concerns weighed on markets. An early election announcement and proposals for expansionary fiscal measures raised questions about the sustainability of public finances, triggering sharp moves in long-dated government bond yields. Economic data painted a mixed picture: industrial production declined on a year-on-year basis in November, while business activity improved, with both manufacturing and services PMIs moving further into expansionary territory. Inflation moderated to 2.1% year-on-year and the Bank of Japan kept policy unchanged, maintaining a cautious stance amid rising sensitivity to bond yields and fiscal risks.

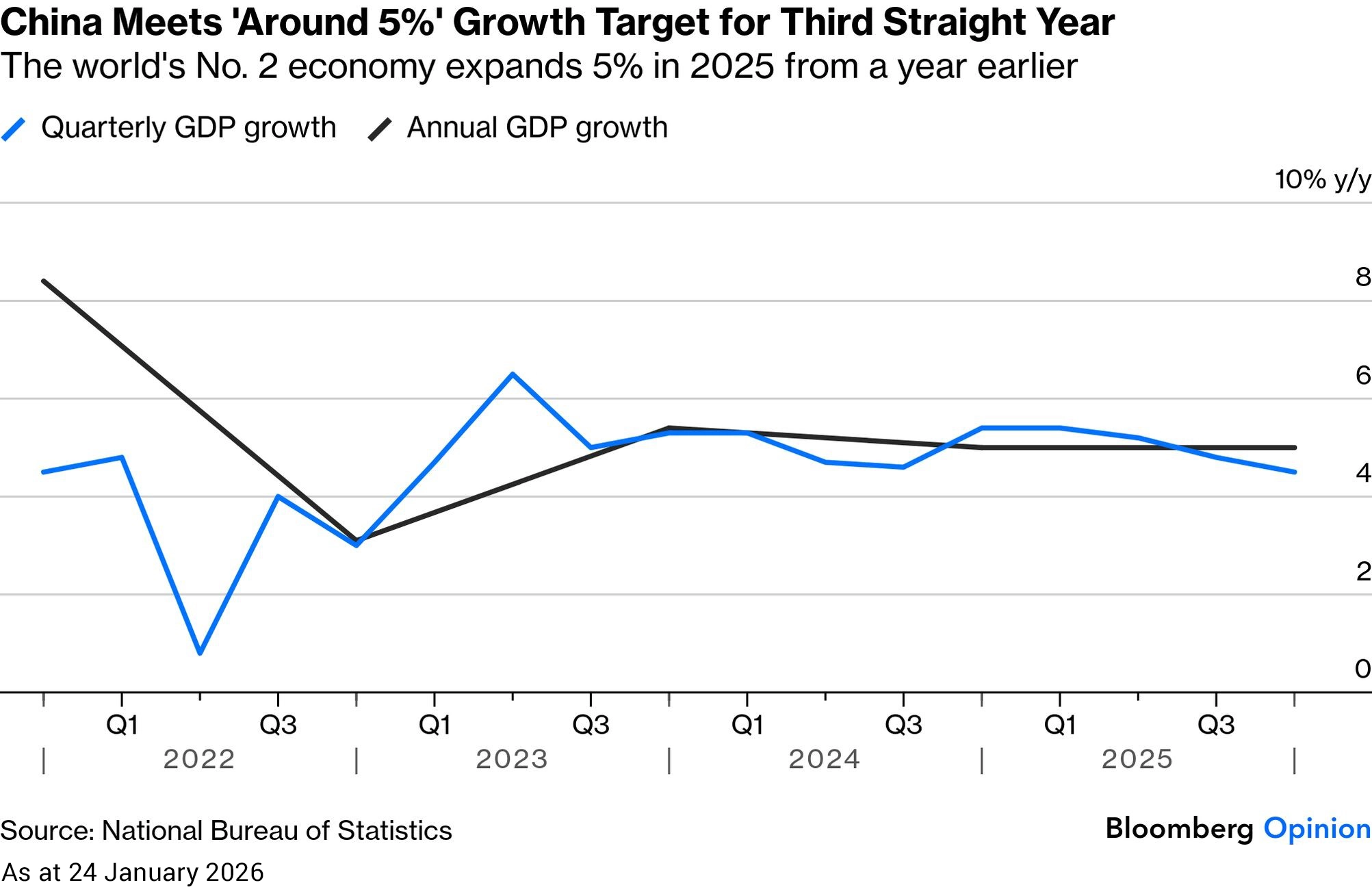

China, meanwhile, reported GDP growth of 4.5% in the fourth quarter and 5% for 2025, again meeting its official target, but underlying trends revealed a more fragile recovery. Nominal growth slowed, fixed asset investment declined for the first time in decades and retail sales remained subdued, underscoring persistent weakness in domestic demand even as industrial output strengthened.

Safe-haven demand lifts commodities amid geopolitical uncertainty

Global equity markets ended last week slightly lower, reflecting a broadly cautious risk environment. The Dow Jones fell 0.53%, the S&P 500 eased 0.35% and the Nasdaq slipped 0.06%. European equities underperformed, with the Euro Stoxx 50 down 1.35% and the FTSE 100 declining 0.90%. In Asia, market performance was mixed: Japan’s Nikkei 225 and Hong Kong’s Hang Seng recorded small losses, while Chinese equities outperformed, with the Shanghai Composite rising 0.84%. Bond markets were relatively stable overall, while commodities strengthened, led by a sharp rally in gold and a solid rise in oil prices. Bitcoin declined over the last week but remains modestly higher on a year-to-date basis.

Stronger rand and easing inflation support South African assets

The South African rand strengthened over the last week, closing near R16.10/$ as markets positioned ahead of the upcoming interest rate decision and continued to price in supportive global and domestic dynamics. The currency remains close to its strongest levels since mid-2022, underpinned by record-high gold prices, improved fiscal metrics, a credible monetary policy framework and a softer U.S. dollar. The rand has gained more than 2% against the dollar since the start of 2026, with further upside possible should commodity prices remain firm and global risk sentiment stay supportive. However, structural constraints, including weak domestic growth prospects and the currency’s inherent volatility, suggest that recent gains remain vulnerable to shifts in global conditions.

On the macro front, inflation remains well contained, reinforcing expectations that monetary conditions could gradually ease in the year ahead. Consumer inflation rose 0.2% month-on-month in December, following a decline in the previous month, while headline CPI increased to 3.6% year-on-year from 3.5%, remaining within the Reserve Bank’s target range. Domestic data painted a mixed picture: retail sales rose 0.6% month-on-month in November and accelerated to 3.5% year-on-year, signalling resilient consumer activity, while mining production deteriorated, falling 5.9% month-on-month and declining 2.7% year-on-year, marking a sharp reversal from the prior month’s gains. Overall, South Africa’s macro environment reflects a cautiously improving inflation backdrop and resilient consumption, tempered by ongoing weakness in the mining sector and a still subdued growth outlook.

Local equities advanced over the last week, with the JSE All Share Index rising 1.76%, supported by a strong rebound in resource stocks (+7.16%) and solid gains in financials (+1.18%), while listed property also advanced (+0.75%). Industrials lagged the broader market, declining 3.02%. The rand strengthened against the U.S. dollar to around 16.10, while the 10-year South African government bond yield declined to 8.15%, reflecting improved sentiment in local fixed income markets.

Chart of the Week

China’s economy grew by 5% in 2025, narrowly meeting its official target despite persistent headwinds from a prolonged property-sector downturn and ongoing trade uncertainty. However, beneath the headline figure, growth momentum weakened, with quarterly expansion slowing to its lowest pace in three years. This divergence points to an uneven and fragile recovery, suggesting that underlying economic conditions remain more subdued than the official data implies. Source: Bloomberg

The information contained in this recording/presentation is for general information purposes only and should not be construed as, nor does it constitute financial, tax, legal, investment or any other advice. Carrick does not guarantee the suitability or potential value of any products or investments discussed herein. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the information, products, services, or any other content contained in this recording for any purpose. Carrick accepts no responsibility for the suitability or accuracy of the information or for any errors or omissions that may occur. Therefore, any reliance you place on such information is strictly at your own risk. This material is provided for general information purposes only and is not personal advice to anyone to invest in any fund or product. Information taken from trade and other sources is believed to be reliable, although Carrick does not represent this as accurate or complete and it shouldn’t be relied upon as such. All material, content, and information provided by Carrick is the intellectual property of Carrick Group and its affiliates, unless otherwise stated. No part of this material may be copied, reproduced, distributed, published, or used for any commercial purpose without Carrick’s prior written consent, and is provided solely for non-commercial use. Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting an investment.