In this Edition:

US markets digest a divided Fed and fading tech momentum

The Federal Reserve delivered a split rate cut while signalling fewer cuts ahead, prompting equity rotation away from technology stocks.

Europe treads water as ECB confidence offsets UK weakness

European markets edged lower as weak UK growth contrasted with steady ECB policy expectations.

Asia diverges as Japan advances and China struggles with deflation

Japanese equities rose on policy expectations, while Chinese markets slipped amid persistent deflationary pressures.

Oil slides while gold shines on easing expectations

Brent crude fell on surplus concerns as gold climbed to record levels on anticipated US monetary easing.

South Africa steadied by policy reform and firmer commodities

Local assets found support from regulatory reforms, easing inflation expectations and stronger gold prices.

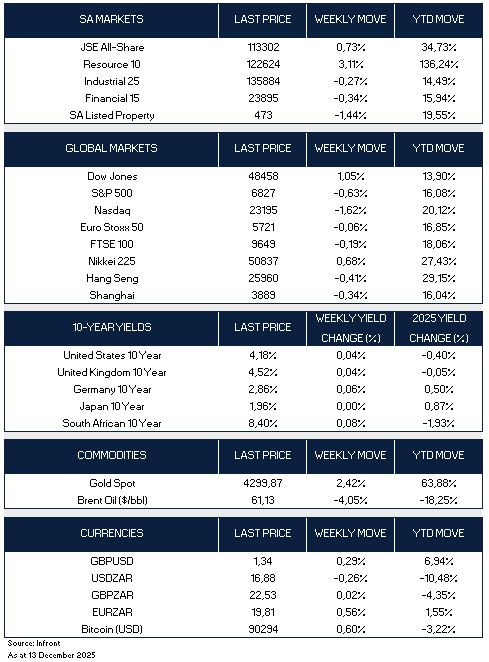

Market Moves and Chart of the Week

US markets digest a divided Fed and fading tech momentum

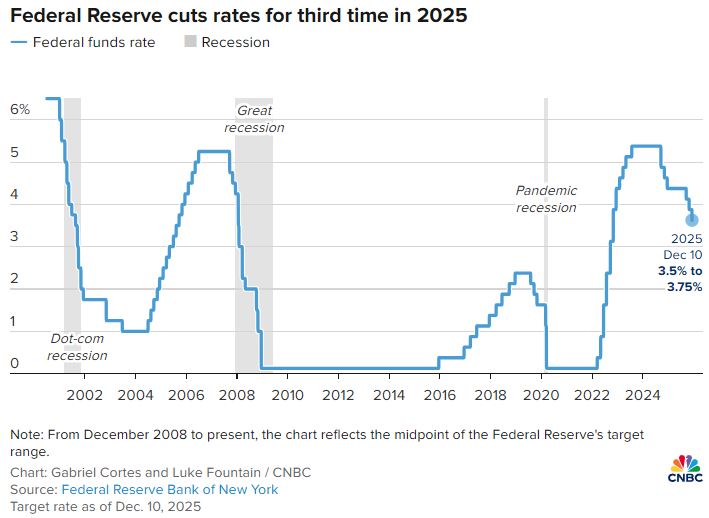

The U.S. Federal Reserve cut interest rates by 25 basis points on Wednesday, as widely expected, marking the third-rate reduction this year. The decision was passed by a 9–3 vote, again highlighting a growing divide within the committee. Hawkish members remain concerned about inflation and favour higher rates, while dovish members are more focused on supporting the labour market through lower borrowing costs.

The Fed’s updated “dot plot” points to a cautious path ahead, with policymakers collectively pencilling in just one additional rate cut in 2026 and another in 2027, underscoring significant disagreement about the future direction of policy. In a further move to support market liquidity, the Fed announced it will resume purchases of U.S. Treasury securities, starting with $40 billion in Treasury bills from Friday.

On the economic outlook, the committee raised its forecast for U.S. GDP growth in 2026 to 2.3%, a half-percentage-point increase from its September projection. Inflation, however, is still expected to remain above the Fed’s 2% target until 2028. The Fed’s preferred inflation gauge showed prices rising at an annual rate of 2.8% in September, well below recent peaks, but still uncomfortably high for policymakers.

Divisions within the Fed have increasingly played out in public, presenting a challenge for Chair Jerome Powell as uncertainty around the U.S. economic outlook persists, particularly in light of President Donald Trump’s aggressive trade policies. President Trump has repeatedly pressured the Fed to cut rates and has signalled that former Fed governor Kevin Warsh is now a leading candidate to succeed Powell when his term expires in May, according to reports.

U.S. equities pulled back on Friday as investors continued to rotate out of technology stocks into more value-oriented sectors. Concerns over elevated valuations and whether heavy spending on artificial intelligence infrastructure will deliver sufficient returns weighed on the tech-heavy Nasdaq Composite. For the last week, the S&P 500 declined 0.6% and the Nasdaq fell 1.6%, while the Dow Jones Industrial Average bucked the trend, gaining 1.1%.

Europe treads water as ECB confidence offsets UK weakness

European markets were modestly weaker. The STOXX Europe 50 Index ended slightly lower, while the UK’s FTSE 100 slipped 0.19%. The European Central Bank is widely expected to keep interest rates unchanged at its December 18 meeting, marking a fourth consecutive hold since its June rate cut. ECB officials struck a relatively confident tone during the last week, with President Christine Lagarde noting that the European economy appears resilient to trade tensions and could see upgraded growth projections later this month.

In the UK, economic data disappointed as GDP unexpectedly contracted by 0.1% in October, following a similar decline in September. Construction was the weakest sector, while services output also fell.

Asia diverges as Japan advances and China struggles with deflation

Asian markets were mixed. Japan’s equities advanced, with the Nikkei Index rising 0.68% for the week. Ahead of the Bank of Japan’s December policy meeting, economists expect a 25-basis-point rate hike to 0.75%, which would mark another step away from ultra-loose policy. In contrast, Chinese markets retreated as investors took profits. The Shanghai Composite fell 0.34% and Hong Kong’s Hang Seng Index slipped 0.41%. Inflation data continued to highlight deflationary pressures in China, with consumer prices rising just 0.7% year on year in November.

Oil slides while gold shines on easing expectations

Brent crude oil prices stabilised around $61 per barrel but were still on track for a weekly decline of more than 4%, driven by expectations of a global supply surplus. Gold prices climbed above $4,300 per ounce, testing record highs last seen in October, and posted a weekly gain of 2.4% on expectations of further U.S. monetary easing.

This week ahead is packed with key data releases. In the U.S., markets will focus on the delayed jobs reports for October and November, November CPI inflation, and retail sales figures. In Europe, monetary policy will be in the spotlight as both the ECB and the Bank of England hold policy meetings. In Asia, investors will watch a range of Chinese economic indicators, while in Japan, attention will centre on the Bank of Japan meeting, where a rate hike to 0.75% is widely anticipated.

South Africa steadied by policy reform and firmer commodities

South Africa’s Communications Minister, Solly Malatsi, has directed the country’s telecoms regulator to amend regulations to allow international players, including Elon Musk’s Starlink, to enter the local market under an alternative empowerment framework. Currently, the Electronic Communications Act requires foreign-owned communications licensees to sell 30% of equity in their South African subsidiaries to historically disadvantaged groups, a requirement that has drawn criticism from Starlink and other global operators.

Under a new policy direction published in the Government Gazette on Friday, so-called “equity equivalent” investment programmes will be recognised as contributing toward empowerment objectives. This change would enable communications companies to bypass the 30% equity requirement, instead meeting empowerment goals through investments such as digital infrastructure and related initiatives, potentially easing market entry for global technology providers.

Investor attention is turning to November consumer inflation data, scheduled for release on 17 December. The data will be closely watched following South Africa’s decision last month to lower its inflation target to 3%, from the previous 3%–6% range. A fourth-quarter survey of business leaders, trade union officials and analysts released on Friday showed a sharp decline in inflation expectations for 2026, suggesting growing confidence in the credibility of the new lower inflation target.

On the Johannesburg Stock Exchange, the JSE All Share Index finished the week 0.73% higher, supported by strong performances from resource companies.

The South African rand was largely steady on Friday, underpinned by firmer gold prices. Currency markets remained cautious ahead of next week’s inflation release, which is expected to provide further insight into the underlying health of Africa’s most industrialised economy.

Chart of the Week

The U.S. Federal Reserve cut its benchmark interest rate by 25 basis points on Wednesday, lowering the federal funds target range to 3.50%–3.75% from 3.75%–4.00%. This marks the third consecutive rate cut since September, bringing total easing this year to 75 basis points and leaving policy rates at their lowest level in more than three years.

The information contained in this recording/presentation is for general information purposes only and should not be construed as, nor does it constitute financial, tax, legal, investment or any other advice. Carrick does not guarantee the suitability or potential value of any products or investments discussed herein. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the information, products, services, or any other content contained in this recording for any purpose. Carrick accepts no responsibility for the suitability or accuracy of the information or for any errors or omissions that may occur. Therefore, any reliance you place on such information is strictly at your own risk. This material is provided for general information purposes only and is not personal advice to anyone to invest in any fund or product. Information taken from trade and other sources is believed to be reliable, although Carrick does not represent this as accurate or complete and it shouldn’t be relied upon as such. All material, content, and information provided by Carrick is the intellectual property of Carrick Group and its affiliates, unless otherwise stated. No part of this material may be copied, reproduced, distributed, published, or used for any commercial purpose without Carrick’s prior written consent, and is provided solely for non-commercial use. Capital is at risk. The value and income from investments can go down as well as up and are not guaranteed. An investor may get back significantly less than they invest. Past performance is not a reliable indicator of current or future performance and should not be the sole factor considered when selecting an investment.