After a strong run since May, global equity markets caught their breath in November. Developed-market (DM) equities eked out a modest gain of around 0.3% for the month, extending the year-to-date advance to just over 20%, but headline index moves masked a sharp rotation below the surface. High-flying technology and AI leaders came under pressure as investors questioned lofty valuations, while defensive sectors such as healthcare and consumer staples finally took the lead.

Macro news flow was dominated by the record 43-day U.S. government shutdown, which ended mid-month but left investors navigating with limited official data. At the same time, mixed growth signals and conflicting commentary from Federal Reserve officials kept rate-cut expectations volatile. By month-end, futures markets were again pricing in a high probability of a December cut.

Emerging markets (EM) lagged DM in November as profit-taking hit several of the year’s best-performing markets, particularly in Asia. Despite the setback, EM equities remain comfortably ahead of DM peers year-to-date.

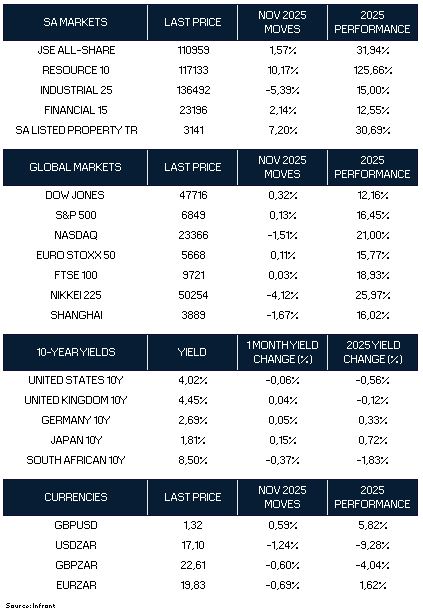

Locally, South African assets again stood out. The FTSE/JSE All-Share Index rose 1.57% in November and is now up 31.94% year-to-date. Resources (+10.17% for the month; +125.66% YTD) resumed leadership, supported by surging precious-metal prices, while listed property (+7.20% MoM; +30.69% YTD) extended its recovery. Financials delivered a solid 2.14% gain, and industrials pulled back 5.39% after a strong run. The rand strengthened 1.24% against the U.S. dollar (USD/ZAR 17.10 at month-end), and the 10-year government bond yield fell to 8.50%, its lowest level in nearly five years.

Key Trends in November:

- SA equities outperformed, driven by resources and property, while industrials lagged and financials held firm.

- Global equities were broadly flat, with mild gains in the U.S. and Europe, profit-taking in Japan and China, and EM equities were weaker despite strong YTD performance.

- Bond markets stayed range-bound, though SA yields fell meaningfully on improved sentiment.

- The dollar eased, and the rand strengthened across major crosses.

- Precious metals remained strong, while oil softened on surplus concerns.

United States: Tech Stumbles as Policy Uncertainty Lingers

Equity Performance:

- Dow Jones: +0.32% | +12.16%

- S&P 500: +0.13% | +16.45%

- Nasdaq: −1.51% | +21.00%

U.S. markets spent much of November digesting the impact of the record-long government shutdown and conflicting signals on the Federal Reserve’s next move. With official economic releases delayed, investors relied on private-sector data, which painted a mixed picture: employment indicators showed both rising unemployment and better-than-expected payroll gains, while consumer confidence weakened sharply.

At the sector level, the most notable development was a pullback in the AI and mega-cap tech cohort. Despite another exceptional earnings beat and upgraded guidance from Nvidia, the stock ended the month sharply lower as investors questioned how much future growth was already priced into the share price. The Magnificent Seven index fell around 1% for the month, and the tech-heavy Nasdaq retreated 1.51%.

Defensive sectors, particularly healthcare (S&P 500 Healthcare Index +9.3% MoM), outperformed as investors rotated into more stable earnings streams. By month-end, futures markets had swung back to pricing a high probability of a December rate cut, even as Fed minutes revealed divisions within the Committee about the appropriate pace of easing.

Outlook:

Strong corporate balance sheets and decent earnings growth still underpin the U.S. market, but the combination of stretched valuations in parts of the tech complex and heightened policy uncertainty argues for a more selective approach, with a greater emphasis on quality and defensiveness.

Europe: Slightly Firmer, but Fiscal and Growth Questions Persist

Equity Performance:

- Euro Stoxx 50: +0.11% | +15.77%

- FTSE 100: +0.03% | +18.93%

European equities in aggregate were little changed in November but continued to modestly outperform the U.S. over the past few months. Early-month weakness linked to global tech volatility gradually faded as investors took comfort from steady PMI readings and inflation gauges that remain close to the European Central Bank’s target.

In the U.K., the Autumn Budget drew attention to a rising tax burden, with roughly GBP 26 billion in new measures announced and the OBR lowering growth forecasts. Nonetheless, inflation continued to drift lower (3.6% YoY), reinforcing expectations for a Bank of England rate cut in December and providing some support to domestic rate-sensitive sectors.

Outlook:

Europe’s equity markets benefit from less tech concentration, more attractive valuations, and a solid 2026 earnings outlook. However, fiscal constraints and still-fragile consumer confidence point to only moderate upside, rewarding active stock selection over broad beta.

Japan: Consolidation After a Strong Run

Equity Performance:

- Nikkei 225: −4.12% | +25.97%

Following multi-year highs earlier in 2025, Japanese equities took a breather in November. AI-linked technology counters, which have been major beneficiaries of global enthusiasm for semiconductor and automation themes, came under pressure as investors reassessed valuations.

On the policy front, the government approved a sizeable JPY 21.3 trillion stimulus package, underscoring its commitment to growth and household support under Prime Minister Sanae Takaichi. At the same time, speculation that the Bank of Japan may need to move more decisively away from ultra-loose policy pushed 10-year JGB yields up to 1.81%, a 0.15 percentage-point rise during the month.

Outlook:

Japan remains one of the more interesting structural stories globally, with ongoing corporate reforms and policy support. However, rising yields and currency volatility could introduce more two-way risk after a very strong year.

China and Emerging Markets: Pause After Outperformance

Equity Performance:

- Shanghai Composite: −1.67% | +16.02%

- MSCI EM: −2.4% MoM | +30.4% YTD (in USD)

Emerging-market equities slipped in November as investors banked profits after a period of strong outperformance versus DM peers. Asia was the focal point of the pullback: Korea and Taiwan, both heavily exposed to the global tech and AI cycle, fell 3–4% in U.S. dollar terms, while India was marginally negative but still ahead of the broader region.

In China, local markets consolidated recent gains. A one-year truce in the U.S.–China trade dispute and ongoing policy support helped offset persistent concerns around the property sector and subdued domestic demand. Industrial profits and producer price data highlighted ongoing deflationary pressures, even as authorities considered further targeted measures to stabilise housing and construction.

Outlook:

Despite November’s setback, EM remains one of the best-performing regions year-to-date. We continue to see selective opportunities, particularly where domestic reforms, commodity leverage or structural growth drivers can supplement the global cycle, but recognise that sentiment is vulnerable to swings in the AI trade and geopolitical headlines.

South Africa: Resource Rally Resumes, Policy Credibility Builds

Equity Performance:

- JSE All-Share: +1.57% | +31.94%

- Resource 10: +10.17% | +125.66%

- Industrial 25: −5.39% | +15.00%

- Financial 15: +2.14% | +12.55%

- SA Listed Property: +7.20% | +30.69%

The JSE was once again among the world’s top performers in November, with the All-Share rising 1.57% and the capped SWIX delivering an even stronger return in U.S. dollar terms. The month marked a renewed surge in commodity-linked counters, as gold and platinum prices rallied around 6%, leaving them up roughly 60–80% year-to-date. Precious metal miners gained around 13% for the month, powering resources to a 10.17% advance.

Domestic policy developments were supportive. Finance Minister Enoch Godongwana’s postponed Medium-Term Budget Policy Statement struck a fiscally prudent tone, with stronger-than-expected tax revenues and a commitment to stabilise debt. Importantly, the adoption of a lower 3% inflation target (with a 2–4% band) brought South Africa closer to international best practice, reducing the inflation risk premium and creating space for structurally lower interest rates.

The South African Reserve Bank responded by cutting the repo rate by 25 bps to 6.75%, taking cumulative easing to 150 bps since September 2024. Bond markets welcomed the combination of credible fiscal and monetary policy: the 10-year yield fell 37 bps to 8.50%, extending a multi-month rally. S&P Global delivered the country’s first sovereign credit upgrade in nearly two decades, citing stronger growth prospects and an improved fiscal trajectory.

The rand strengthened 1.24% against the U.S. dollar in November and is now about 9% stronger year-to-date. Listed property gained 7.20% as lower yields filtered into valuations, while financials rose 2.14%. On the negative side, Naspers and Prosus detracted, reflecting uncertainty around future buyback programmes despite solid underlying execution.

Outlook:

South Africa’s improving policy backdrop, high real yields and exposure to buoyant precious-metal markets leave local assets well-placed, although global risk sentiment and domestic growth constraints remain key swing factors.

Currencies and Commodities: Weaker Dollar, Strong Precious Metals, Softer Oil

The U.S. dollar eased modestly in November (DXY −0.3% MoM) as mixed data and dovish Fed commentary nudged expectations toward further easing. The rand’s 1.24% gain versus the dollar (USD/ZAR 17.10) was accompanied by modest appreciation on the crosses: GBP/ZAR −0.60% MoM and EUR/ZAR −0.69% MoM. GBP/USD finished the month at 1.32, up 0.58%.

Gold continued to benefit from safe-haven demand and speculation that real policy rates have peaked, ending the month above $4,000/oz. Platinum tracked higher as well, aided by China’s launch of physically settled platinum futures, a structural positive for liquidity and pricing, providing an additional tailwind to South African PGM producers. By contrast, Brent crude hovered around $64–65/bbl, as concerns about a looming supply surplus outweighed geopolitical risk and new sanctions news flow.

Fixed Income: Range-Bound Globally, Rally Locally

10-Year Benchmark Yields (End-Nov | MoM change | YTD change):

- United States: 4.02% | −0.06% | −0.56%

- United Kingdom: 4.45% | +0.04% | −0.12%

- Germany: 2.69% | +0.05% | +0.33%

- Japan: 1.81% | +0.15% | +0.72%

- South Africa: 8.50% | −0.37% | −1.83%

Global bond markets delivered modest positive returns (~0.2%) as slightly softer U.S. labour market data and weaker consumer confidence readings encouraged expectations of additional easing, while concerns about higher future issuance limited gains. U.S. Treasuries led performance (+0.6% for the month), with yields drifting lower across the curve.

Gilts were broadly flat (+0.1%) as an uneventful Budget and guidance of lower future supply steadied the market. German Bunds underperformed slightly in the eurozone as increased net borrowing projections weighed on sentiment, while Japanese government bonds were notable laggards, with yields rising on fears that expansive fiscal policy and a weaker yen could stoke more persistent inflation.

South African bonds stood out once again, supported by a rare alignment of factors: credible fiscal consolidation, a lower inflation target, falling inflation prints and continued foreign interest in high real yields. The sharp rally in the R2035 and surrounding maturities reinforced our constructive view on local duration as a valuable portfolio diversifier.

Final Thoughts: Rotation, Not Reversal

November marked a pause in headline equity gains, but underneath the surface, we saw an important rotation: the AI and mega-cap tech winners of the past year stumbled, while defensive sectors and previously overlooked regions fared better. Emerging markets, including South Africa, reminded investors of their capacity to outperform over a full cycle but also of their vulnerability to swings in sentiment.

For now, the macro backdrop remains one of moderating inflation, gradually slowing growth, and central banks edging, cautiously, toward easier policy. That combination favours selectivity rather than blanket risk-on positioning.

What this means for portfolios:

- Avoid excessive concentration in mega-cap tech and AI leaders. Maintain exposure, but balance it with quality healthcare, consumer staples and other defensive sectors that can deliver more consistent earnings through the cycle.

- Stay regionally diversified. Combine U.S. exposure with allocations to Europe, Japan and select EM markets where valuations are more reasonable and policy backdrops supportive.

- Retain high-quality bond exposure. Developed-market investment-grade and South African government bonds continue to offer attractive real yields and diversification benefits if AI enthusiasm fades or growth slows more sharply.

- Lean into South African opportunities selectively. We favour balanced exposure to local bonds, financials, listed property and high-quality resource counters, while remaining mindful of domestic growth constraints and political risk.

- Keep alternatives and real assets in the mix. Hedge funds, commodities and other diversifying strategies remain important tools for managing volatility and tail risks as markets transition into a more mature phase of the cycle heading into 2026.