In this Edition:

Soft landing hopes lift US equities:

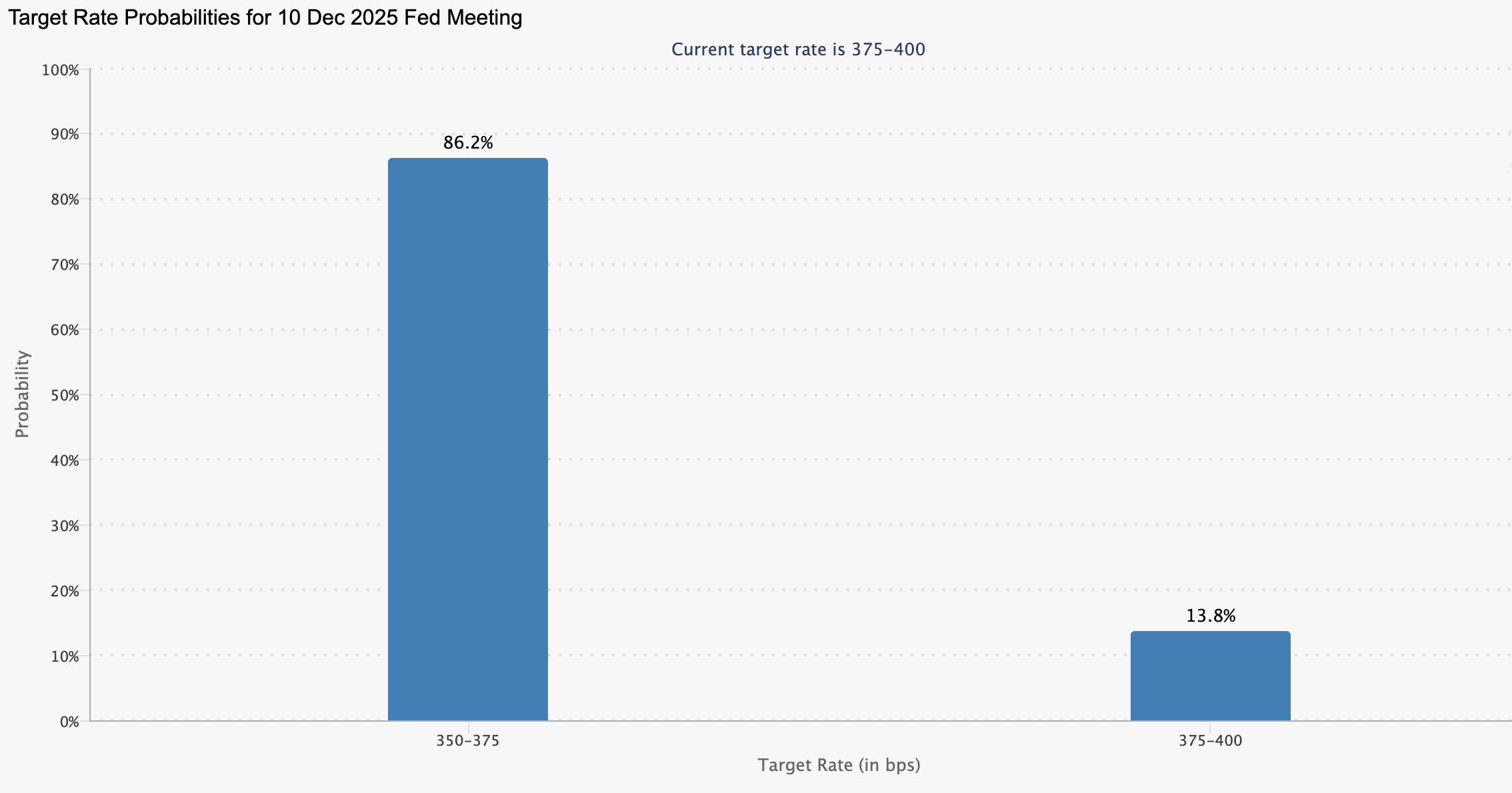

US equities strengthened at the start of December as investors looked toward the final Federal Reserve meeting of the year, maintaining expectations for interest rate cuts in 2026.

Rate-cut hopes support European markets despite uneven growth:

European equities posted modest gains as cooling inflation reinforced expectations for earlier policy easing across the region.

Asia stays cautious as China softens and BOJ stance shifts:

Asian markets edged higher, supported by selective buying in Chinese tech and AI sectors, even as broader economic data remained fragile and Japan’s policy path grew less certain.

South Africa benefits from a stronger rand and supportive commodity trends:

South African assets tracked the global risk-on tone, buoyed by a firmer rand, improved external balances, and commodity moves that continue to shape the local inflation outlook.

Market Moves and Chart of the Week

Soft landing hopes lift US equities

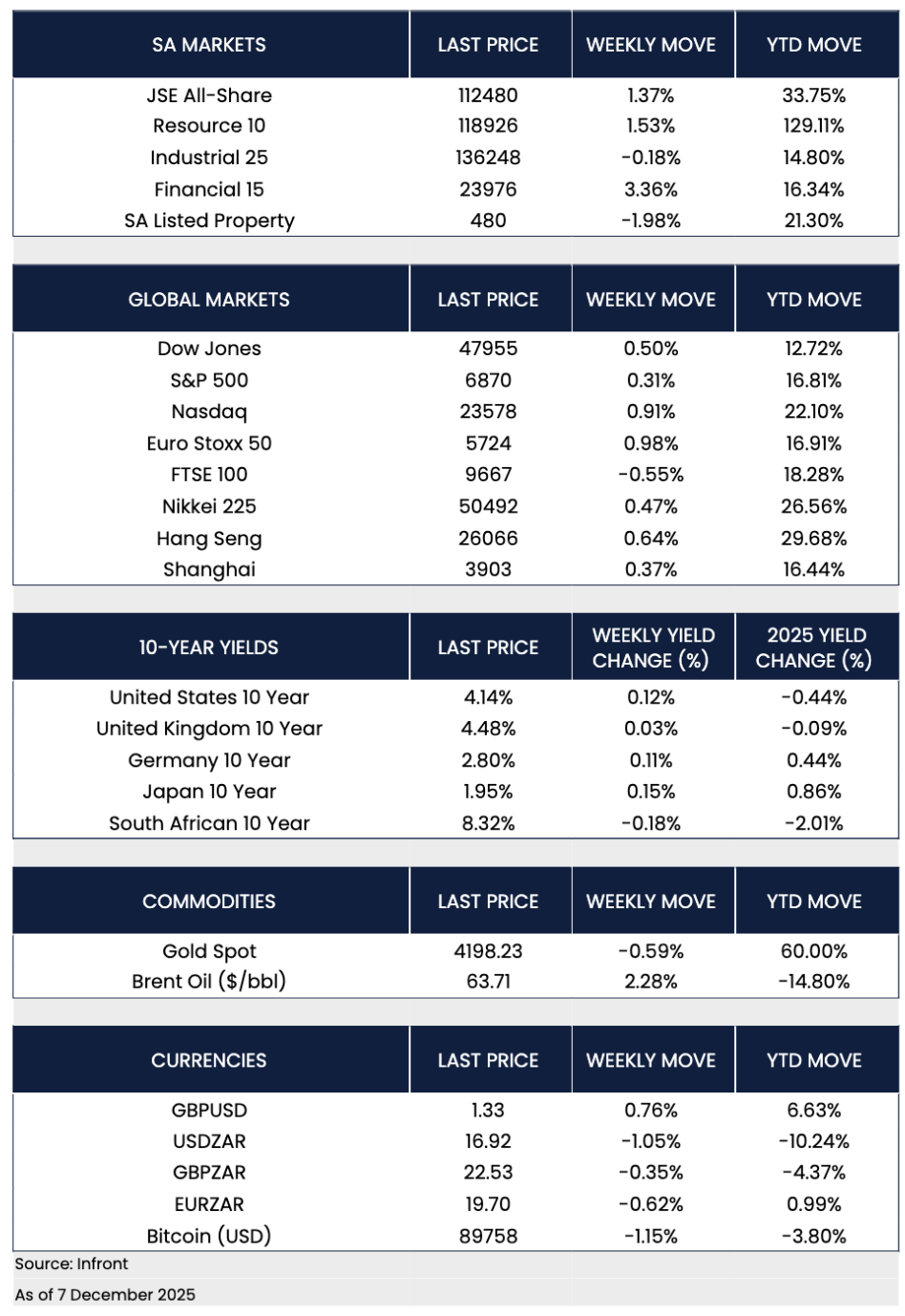

US equities started December on a stronger note, with investors looking ahead to the last US Federal Reserve meeting of the year and still expecting interest rate cuts at some point next year. Over the last week, the Nasdaq rose 0.91%, the Dow gained 0.50%, and the S&P 500 increased 0.31%.

A key survey of factories (the ISM manufacturing index) fell to 48.2, which signals manufacturing is still shrinking, with weaker new orders and hiring, and companies still facing rising input costs. The services side of the economy, which includes areas like finance, healthcare and hospitality, looked healthier. The ISM services index moved up to 52.6, and the survey showed some easing in price pressures, which is positive for inflation. Jobs data suggest the labour market is cooling but not collapsing: payroll company ADP reported that private companies cut 32,000 jobs in November and layoff announcements rose, but new unemployment claims actually fell to their lowest level since 2022.

On inflation, the Federal Reserve’s preferred measure, the core Personal Consumption Expenditures (PCE) price index, showed an annual rate of 2.8%. The monthly increase of 0.2% was in line with expectations, while headline PCErose 0.3%. That is broadly in line with the Fed’s plan to bring inflation down gradually. As a result, longer-term US government bond yields moved higher, which hurt bond prices. Corporate bonds, especially high-yield, held up better as investors remained comfortable taking some risk.

Rate-cut hopes support European markets despite uneven growth

European stock markets were slightly positive overall. Investors are becoming more confident that the next move from major central banks in Europe is likely to be interest rate cuts rather than more hikes. The Euro Stoxx 50 index, which tracks large companies in the euro area, rose 0.98% over the last week. In contrast, the UK’s FTSE 100 fell 0.55%, meaning UK shares underperformed their euro area peers.

In the eurozone, inflation looks like it is gradually settling near the European Central Bank’s target. Headline inflation picked up a little to 2.2% in November, and core inflation stayed at 2.4%. Lower energy prices are helping, but services inflation is still relatively sticky. Economic growth surprised slightly on the upside, with third-quarter GDP revised up to 0.3% compared with the previous quarter, supported mainly by France and Spain, while Germany’s economy was flat. The unemployment rate stayed low at 6.4%. German factory orders rose 1.5% month on month, a second straight increase, thanks to demand for items like aircraft, trains and military equipment, as well as stronger metal production. This suggests the worst of the downturn in German industry may be behind us.

In the UK, the housing market is soft but not crashing. Nationwide’s house price index showed a 0.3% increase in November, even though there are concerns about taxes and the broader budget outlook. Bank of England data showed only a small drop in new mortgage approvals. Overall, the UK economy appears to be growing slowly and unevenly, but there are no clear signs of a severe recession, which gives the Bank of England room to slowly shift toward lower interest rates if inflation continues to fall.

Asia stays cautious as China softens and BOJ stance shifts

Chinese shares inched higher as investors moved back into local technology and artificial intelligence stocks, even though the broader economic data remains weak. In Hong Kong, the Hang Seng index rose 0.64%, while the onshore Shanghai Composite gained 0.37%. The gains were driven mainly by interest in specific growth sectors rather than a positive view on the whole market.

The latest business surveys highlight how fragile the recovery still is. The official manufacturing index rose slightly to 49.2 in November, but it has now been below 50 for eight months, which means factory activity is still shrinking overall. The services and construction index slipped to 49.5, its first reading below 50 in nearly three years, reflecting ongoing pressure from the property sector. China’s long-running property adjustment, which started after the government tightened rules on developer borrowing with the “three red lines” policy, continues to hurt confidence and push prices lower in some areas. Authorities are providing support, but in a gradual and targeted way rather than through a big stimulus package. For investors, that means opportunities are most likely to be found in specific policy-supported or growth areas, rather than across the entire Chinese market.

Japanese stocks were mixed as investors reconsidered how quickly the Bank of Japan might move away from its very loose monetary policy. The Nikkei 225 index rose 0.47%, while the broader TOPIX index slipped slightly, showing that gains were not evenly spread across the market. The key trigger was a speech by Bank of Japan Governor Ueda, which investors viewed as slightly more hawkish and therefore a sign that interest rate hikes are getting closer.

Stronger rand and improved external finances buoy South African assets

South African markets generally moved in line with the improved global sentiment, while local attention focused on better external finances and renewed access to global bond markets. The rand strengthened further below the key 17.00 level, trading around 16.94 to the dollar on Friday. That is roughly 0.4% stronger on the day and just over 1% firmer over last week. The currency was helped by a smaller-than-expected current account deficit, which narrowed to 0.7% of GDP in the third quarter from 1.0% in the second quarter. This means South Africa needed less foreign capital to fund its imports and other outflows. The government also returned to the international bond market with its first dollar Eurobond issuance since 2024, with initial yield guidance between 6.625% and 7.750% on 12-year and 30-year bonds, pointing to solid investor demand. Confidence was further supported by an improvement in foreign reserves, which rose to 70.0 billion dollars in November from 69.4 billion in October.

Local shares had a good week. The JSE All Share Index rose 1.37%. Resource stocks gained 1.53%, helped by the rand and commodity moves, while financial shares climbed 3.36% as banks and insurers benefited from a stronger rand and lower bond yields. Industrial shares were slightly weaker, falling 0.18%, and listed property gave back 1.98% after a strong run, as investors took some profits and remained cautious on the local growth outlook.

South African government bonds performed better than many developed market bonds. The key 10-year bond yield fell 18 basis points over the last week to around 8.32%, and the 2035 bond traded near 8.31%. Lower yields mean higher bond prices and reflect ongoing demand for South Africa’s relatively high interest rates, especially as global investors start to look ahead to possible US rate cuts in 2026.

In commodities, for the last week, Brent oil was up 2.28% and gold was down 0.59%. This combination is generally supportive for South Africa, although investors will watch closely to see how cheaper fuel and a stronger rand impact inflation and consumer spending over the coming months.

Chart of the Week

The dollar blinks first. The US Dollar Index has broken below its mid-November low as markets lean into a December Fed rate cut, with weaker US data and dovish expectations dragging the greenback lower. The softer dollar has helped fuel the rebound in global risk assets, supported the rand’s break below 17 to the US dollar, and eased financial conditions into year-end; neatly tying together this week’s themes of Fed policy, stronger equities and firmer emerging market currencies.