In this Edition:

Markets rise on dovish Fed signals and cooling economic momentum

Dovish Fed commentary, softer data, and mixed labour indicators lifted markets while reinforcing expectations of a December rate cut.

Stabilisation emerges as inflation remains subdued across the region

Eurozone data showed mild improvement and low inflation, while the UK’s Autumn Budget introduced significant new taxes.

Geopolitical tensions intensify as Japan posts mixed economic data and China’s momentum softens

Tensions between China and Japan escalated, Japan delivered mixed economic outcomes, and China balanced equity gains with weakening industrial activity.

Oil softens while platinum strengthens on China’s physically settled futures launch

Oil prices drifted lower ahead of OPEC+, while China’s introduction of platinum futures improved prospects for PGM producers.

Policy reforms, tax proposals and market divergence shape the domestic landscape

Government explored a tax on online gambling, Nersa advanced electricity-market reform, and South African markets diverged as resources outperformed.

Market Moves and Chart of the Week

Markets rise on dovish Fed signals and cooling economic momentum

U.S. markets ended the holiday-shortened week higher, supported by dovish signals from Federal Reserve officials and a run of softer economic data that strengthened expectations of a December rate cut. Small caps outperformed, the Nasdaq bounced back on renewed AI optimism, and overall sentiment remained constructive despite typically thin Thanksgiving trading volumes.

U.S. economic releases pointed to cooling momentum. Retail sales slowed sharply, core control-group sales contracted, and producer price inflation remained contained. Durable goods orders offered a pleasant upside surprise, though business surveys such as the Chicago PMI and Richmond Fed continued to signal softer underlying activity. Labour market indicators were mixed: initial jobless claims fell to a seven-month low, suggesting employers remain reluctant to cut staff, while continuing claims nudged higher. Meanwhile, consumer sentiment deteriorated meaningfully as surveys highlighted mounting concerns over inflation, job security and household finances heading into the holiday season.

The Fed’s Beige Book reinforced the narrative of a gradually slowing economy, noting slightly weaker employment, moderate price pressures and softer consumer spending. Markets became increasingly sensitive to policy signals after comments from senior Fed officials and reports that Kevin Hassett may replace Jerome Powell, both of which reinforced expectations that the next move will likely be a rate cut. Bond yields drifted lower, the dollar softened, and tech stocks rallied on further AI-related developments.

Stabilisation emerges as inflation remains subdued across the region

Across Europe, data continued to point to mild stabilisation. Germany’s GDP flatlined after a prior contraction, and consumer confidence improved slightly, while France recorded a small dip in sentiment. Eurozone-wide confidence held steady, and inflation remained subdued across major economies, keeping the headline CPI reading close to the ECB’s 2% target. In the UK, the Autumn Budget introduced GBP 26 billion in new taxes, prompting the OBR to lower growth forecasts and highlight a rising long-term tax burden.

Geopolitical tensions intensify as Japan posts mixed economic data and China’s momentum softens

Tensions in East Asia escalated as China criticised Japan’s position on Taiwan and imposed travel and import restrictions, heightening geopolitical risks in the region. Despite this backdrop, Japan’s economic readings were mixed: inflation held steady, unemployment remained unchanged and industrial production softened. Japanese equities nevertheless advanced on dovish U.S. signals, while speculation around a possible BoJ rate hike pushed the 10-year JGB yield toward 17-year highs.

In China, equity markets rose as renewed enthusiasm for domestic tech and AI overshadowed concerns about slowing economic momentum. Industrial profits unexpectedly declined, and producer prices remained in deflation, signalling still-weak underlying demand. Even so, most analysts continue to expect China to meet its 5% growth target, supported by ongoing policy measures and relatively steady consumer sectors.

Oil softens while platinum strengthens on China’s physically settled futures launch

Broader geopolitical developments added fresh dynamics to global markets. Growing optimism around potential peace in Ukraine and the prospect of a new U.S.–China trade agreement triggered debate about asset-allocation shifts for 2026. Defence stocks pulled back, while reconstruction-linked materials gained strongly. Oil prices edged lower ahead of the OPEC+ meeting as markets weighed diplomatic developments against supply expectations, with Brent drifting toward $62 a barrel amid signs of a growing global surplus.

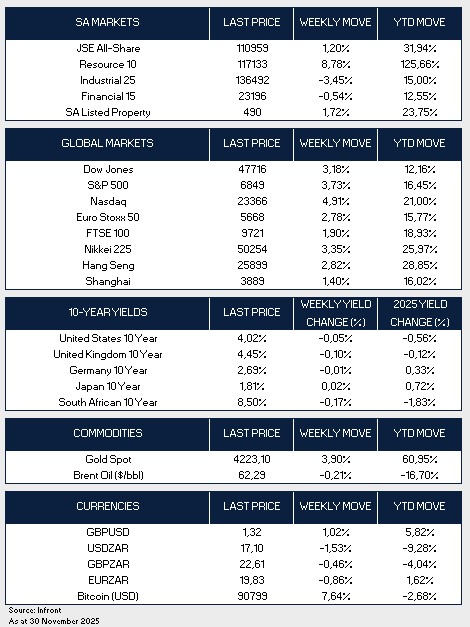

Global markets closed the week firmly higher, buoyed by improving risk appetite and ongoing optimism around U.S. monetary easing. All three major U.S. indices posted strong gains, led by a 4.91% rise in the Nasdaq. European equities also pushed higher, while in Asia, Japan’s Nikkei 225 climbed 3.35%, Hong Kong’s Hang Seng rose 2.82% and the Shanghai Composite added 1.40%. Bond yields were mostly softer, with U.S., UK and German yields edging lower as rate-cut expectations strengthened, while Japan’s 10-year yield moved higher to 1.81% on growing expectations of BoJ tightening.

Policy reforms, tax proposals and market divergence shape the domestic landscape

South Africa is considering a 20% tax on online gambling to slow the industry’s rapid expansion and limit related social harms. Treasury expects the measure could raise about R10 billion, but stresses that the main objective is to curb problem gambling, which has surged alongside smartphone adoption and economic strain. Participation has risen sharply, and total wagers reached R1.5 trillion in 2024/25, almost one-third higher than the previous year. The proposal follows global trends – such as the UK’s 21% remote gaming tax – and may include stricter reporting and registration requirements for online operators.

Nersa has taken three major steps toward launching South Africa’s competitive wholesale electricity market in April 2026: approving a market-operator licence for Eskom’s NTCSA, finalising grid access rules, and establishing the Electricity Market Advisory Forum. However, it is withholding final licence conditions until NTCSA outlines how it will prevent conflicts of interest with Eskom, which will compete alongside other generators. Industry bodies have welcomed the reforms as long-overdue measures that improve transparency, strengthen oversight, and support a more competitive investment environment.

Other economic developments included a 1.2% MoM decline in South Africa’s leading business cycle indicator for September and mixed producer inflation data, with PPI down 0.1% MoM but up 2.9% YoY in October. Globally, China’s launch of physically settled platinum futures boosted platinum prices and offered a structural positive for South African PGM producers. Meanwhile, U.S. President Donald Trump escalated political tensions by declaring South Africa would not be invited to the 2026 G20 Summit, questioning its membership and threatening to halt U.S. support.

South African markets delivered a mixed performance over the last week, with the JSE All Share Index rising 1.20% as a sharp rebound in resources (+8.78%) offset weakness in industrials (-3.45%) and financials (-0.54%). Resource counters continued to surge on stronger commodity prices, while listed property added 1.72%, extending its solid year-to-date gains. The rand strengthened meaningfully, appreciating 1.53% to R17.10/$ alongside broader U.S. dollar softness, and the South African 10-year government bond yield declined 17 basis points to 8.50%, supported by improved global risk sentiment and expectations of further monetary easing abroad.

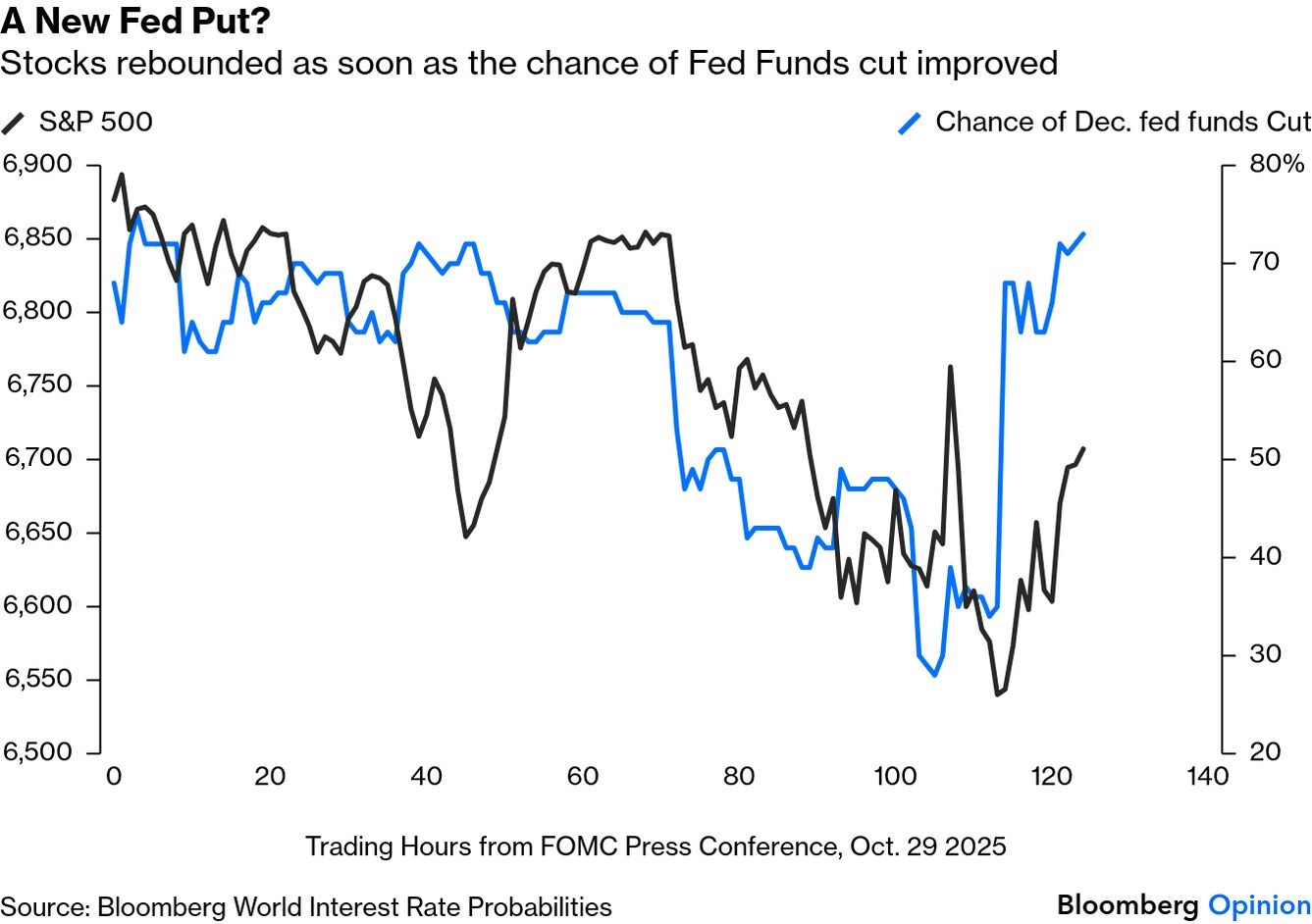

Chart of the Week

The correction has been corrected. The Nasdaq 100 opened this week with its best daily performance since May, rallying 2.6% as risk assets rebounded. This seemed driven less by tech news and more by shifting interest rate expectations. By late last week, hopes for a December Fed funds rate cut had faded as stocks sold off, but a couple of dovish comments from senior Federal Reserve officials quickly reversed sentiment. Futures markets raised the probability of a December cut to above 70%, and equities rallied with it. Source: Bloomberg