In this Edition:

US Government Reopens as Shutdown Ends and Markets React to Policy Shifts

The US ended its historic government shutdown, struck a major trade deal with Switzerland, and saw mixed equity performance driven by AI spending concerns and valuation pressures.

European Markets Lift on US Reopening but UK Data Weakness Adds Pressure

European equities rose on improved global sentiment, while weak UK labour and GDP data heightened expectations of a near-term Bank of England rate cut.

Asia Sees Mixed Momentum as Japan Edges Higher and China Pulls Back

Asian markets delivered a mixed week, with Japan posting slight gains while Chinese indices softened amid profit-taking and weak housing data.

Commodity Markets Stabilise as Oil Rebounds and Gold Holds Firm

Oil prices recovered from steep losses following geopolitical disruptions, while gold ended the week higher despite late-week pressure from hawkish US Fed commentary.

South African Fiscal Outlook Brightens as MTBPS Boosts Investor Confidence

South African sentiment improved sharply as the MTBPS highlighted better-than-expected revenue, stabilising debt, and a surprise sovereign rating upgrade..

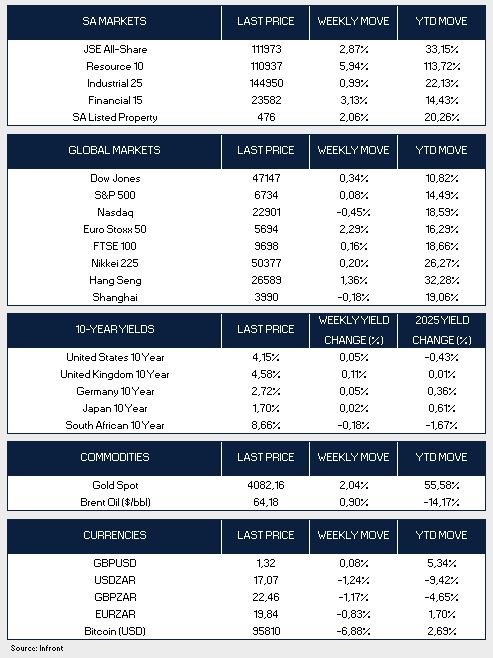

Market Moves and Chart of the Week

US Government Reopens as Shutdown Ends and Markets React to Policy Shifts

President Donald Trump on Wednesday signed legislation to end the longest government shutdown in U.S. history. The move followed a 222–209 vote in the House to restore food assistance programs, resume pay for roughly 800,000 federal workers, and revive air-traffic control operations. While Republicans largely held together with Trump’s backing, House Democrats voiced frustration that the standoff ended without securing an extension of federal health insurance subsidies.

Switzerland and the United States have concluded a significant trade agreement that will materially reduce bilateral tariffs and expand cross-border investment flows. As part of the deal, the U.S. will lower tariffs on Swiss imports from 39% to 15%, providing Swiss exporters with meaningful cost relief and improving market access. In return, Switzerland has committed to invest $200 billion into the U.S. economy, reinforcing its position as a key strategic partner. Additionally, Switzerland will eliminate tariffs on a designated quota of U.S. meat exports, including beef, bison, and poultry, broadening opportunities for American producers within the Swiss market.

U.S. equities were mostly lower through Thursday as elevated valuations and intensifying scrutiny of artificial intelligence spending spurred a rotation out of growth-oriented stocks -many of which had driven indexes to recent record highs. A volatile session on Friday saw a rebound, with investors snapping up major technology names following the market’s worst single-day decline in more than a month. Despite the turbulence, the Nasdaq ended last week down 0.5%, while the S&P 500 and the Dow managed modest gains of 0.1% and 0.3%, respectively.

European Markets Lift on US Reopening but UK Data Weakness Adds Pressure

In Europe, the pan-European STOXX 50 Index advanced 2.29% following relief over the reopening of the U.S. federal government, while the UK’s FTSE 100 was largely unchanged. A string of weaker-than-expected UK labour and economic data weighed on sentiment, prompting a sharp increase in expectations for a Bank of England rate cut in December. Unemployment rose to 5% for the three months through September – its highest level since early 2021 – while Q3 GDP growth slowed to 0.1%, missing the 0.2% consensus.

Asia Sees Mixed Momentum as Japan Edges Higher and China Pulls Back

Japan’s equity markets posted minimal gains for last week, with the Nikkei 225 rising 0.20%. Investor expectations surrounding potential policy shifts under newly appointed Prime Minister Sanae Takaichi, including continued fiscal support and a cautious approach by the Bank of Japan toward tightening, put downward pressure on the yen.

Mainland Chinese markets retreated as investors took profits after recent gains pushed benchmarks to near four-year highs. The Shanghai Composite slipped 0.18%, while Hong Kong’s Hang Seng Index added 1.26%. Chinese housing market data continued to signal strain, with new home prices across 70 cities falling 0.45% in October – the sharpest monthly drop in a year.

Commodity Markets Stabilise as Oil Rebounds and Gold Holds Firm

Oil prices were steady on Thursday after a 4% decline the previous session, as markets weighed global oversupply concerns against new U.S. sanctions on Russia’s Lukoil. Prices rebounded on Friday, rising more than $1 after a Ukrainian drone strike halted exports from Russia’s key Black Sea port of Novorossiysk. Brent crude ended the week at $64.18 per barrel, gaining 0.9%.

Gold prices eased toward the end of last week following hawkish commentary from Federal Reserve officials; however, the metal still finished the week more than 2% higher at $4,082 per ounce, compared with the previous week’s close.

South African Fiscal Outlook Brightens as MTBPS Boosts Investor Confidence

Finance Minister Enoch Godongwana delivered an optimistic tone in his Medium-Term Budget Policy Statement (MTBPS) on Wednesday, highlighting stronger-than-expected revenue and signs of a gradually recovering economy. Tax revenue for the year is projected to come in R19.7 billion higher than expected, reflecting improved household spending and corporate tax collections. He noted progress in stabilising public debt, fostering economic growth, and removing South Africa from the Financial Action Task Force grey list, achievements he attributed to collaboration across government, law enforcement, and the private sector.

Tax collections for the first half of the 2025 budget period have risen 9.3% above estimates, reaching R924.7 billion, prompting the Treasury to revise gross tax revenue upward by R19.7 billion. Despite this progress, South Africa’s slow-growth trajectory remains a concern, with GDP growth projected at 1.2% in 2025 and averaging 1.8% from 2026 to 2028. The budget deficit is forecast to narrow slightly to 4.7% of GDP in 2025/26, with government debt stabilising at 77.9% of GDP.

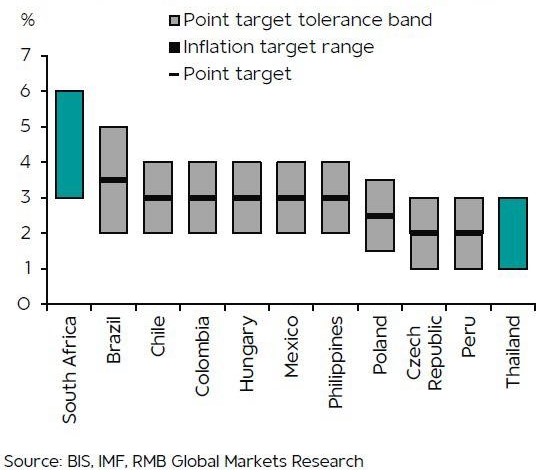

The government and labour unions agreed to a three-year wage deal in February 2025, with a 5.5% increase in the first year and CPI-linked adjustments thereafter. The revision of the inflation target may necessitate adjustments to this agreement.

In a further boost to investor confidence, South Africa secured its first credit rating upgrade in nearly two decades on Friday, with S&P Global raising the country’s foreign-currency long-term sovereign rating to “BB” from “BB-.” The upgrade reflected stronger growth prospects, an improving fiscal outlook, and reduced contingent liabilities following better performance at Eskom. S&P expects GDP growth to rise to 1.1% in 2025 and average 1.5% through 2026–2028.

The positive sentiment was reflected on the Johannesburg Stock Exchange, where the All Share Index rose 2.87% for last week, supported by gains in resource and financial stocks. The rand strengthened to R17.07/$ at Friday’s close, marking its strongest level against the dollar in nearly three years.

Chart of the Week

According to Treasury’s medium-term budget, South Africa’s 3%–6% inflation target has historically been an outlier among emerging markets, undermining competitiveness and contributing to rand depreciation. Gradually adopting a lower target is expected to reduce both inflation and inflation expectations, creating room for permanently lower interest rates. Aligning the target with international best practice also lowers the cost of borrowing by reducing the inflation risk premium demanded by investors lending to South Africa.