Market Snapshot: Resilient Sentiment and Policy Support

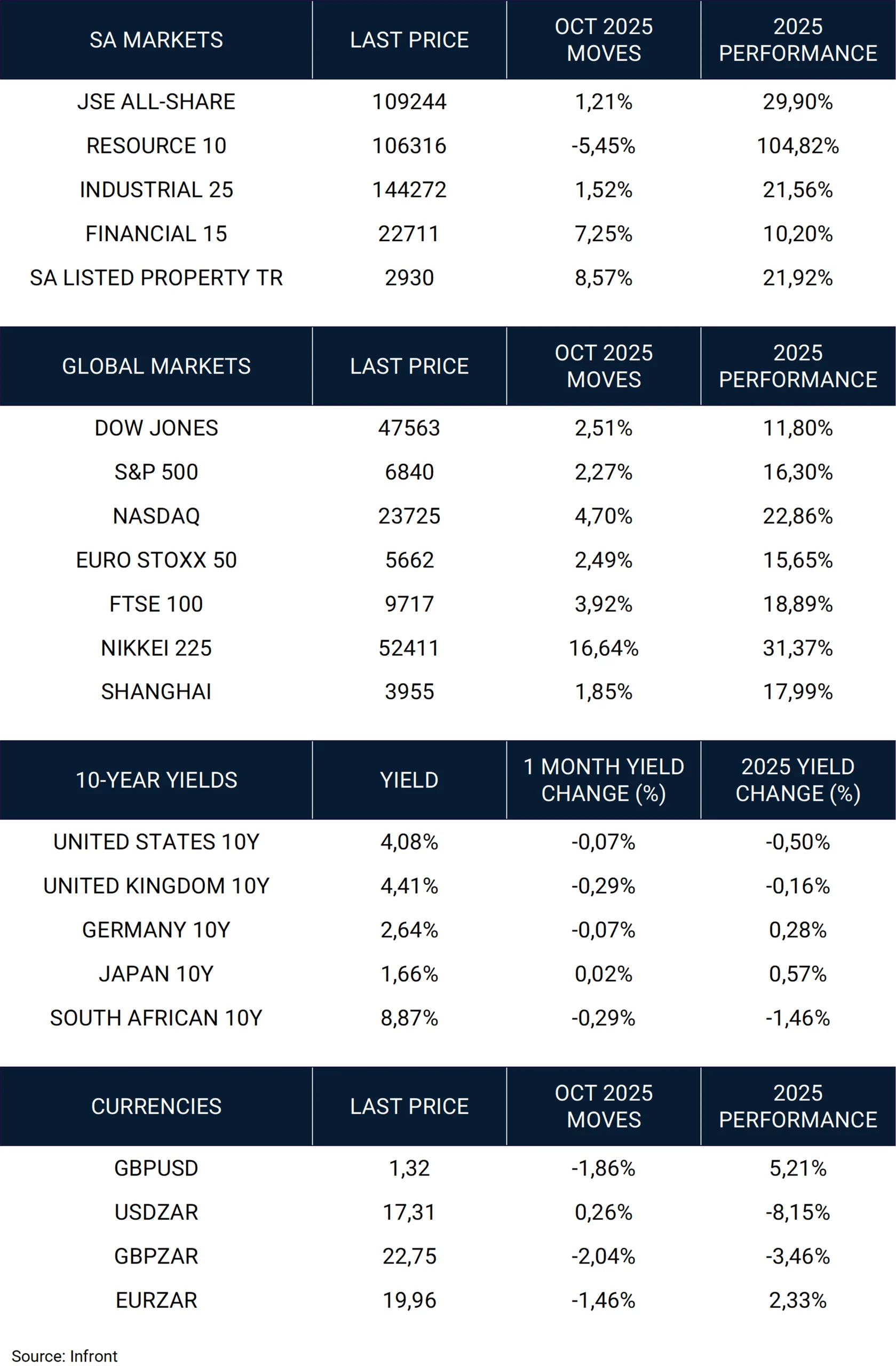

Global markets extended their advance in October, shrugging off early volatility from renewed tariff tensions and a prolonged U.S. government shutdown. Investor sentiment stabilised as the Federal Reserve delivered another 25 bps rate cut and reaffirmed its data-dependent stance, while U.S.-China trade discussions showed tangible progress. Corporate earnings remained robust, with more than 80% of S&P 500 constituents exceeding expectations.

Japan led global performance with a record-breaking rally following the election of a reform-minded prime minister and continued yen weakness. In Europe, moderating inflation, improving business confidence and lower bond yields supported modest gains across indices. In contrast, mainland China’s performance was subdued as domestic demand and property activity remained soft despite firmer exports.

Locally, the JSE posted its eighth consecutive monthly gain, supported by strong returns from financials (+7.3%) and listed property (+8.6%), while resources (-5.5%) paused after months of exceptional strength. The rand was largely stable, the bond market firmed on lower yields, and South Africa’s removal from the FATF grey list improved investor sentiment.

Key Trends in October:

- Global equities: Broadly higher; Nikkei (+16.6%), Nasdaq (+4.7%), FTSE 100 (+3.9%), and S&P 500 (+2.3%) led.

- Global bonds: Yields drifted lower across most markets as disinflation persisted; SA 10-year yield fell 29 bps to 8.87%.

- Commodities: Gold and PGMs consolidated near record highs; Brent crude softened 2.9% to ~$65/bbl.

- Currencies: Dollar mixed; rand −0.3% vs USD, stronger against GBP and EUR.

- South Africa: Inflation held at 3.4% YoY; fiscal position steady ahead of November’s Mid-Term Budget.

United States: Growth Momentum and Earnings Support

Equity Performance:

- Dow Jones: +2.51% (YTD +11.80%)

- S&P 500: +2.27% (YTD +16.30%)

- Nasdaq: +4.70% (YTD +22.86%)

U.S. equities advanced to new highs as another strong earnings season overshadowed the political noise from Washington. The Fed’s 25 bps cut to 3.75–4.00% was widely expected, but Chair Powell’s comment that a further reduction in December was “not a foregone conclusion” signalled a more cautious stance. Inflation continued to trend lower, with core CPI steady at 3.0%, while job creation slowed modestly.

Outlook:

Resilient consumption and earnings strength remain supportive, though valuations are elevated and policy expectations appear fully priced. A pause in December would allow the Fed to gauge the cumulative effect of recent easing.

Europe: Modest Gains Amid Fiscal Risks

Equity Performance:

- Euro Stoxx 50 +2.49% (YTD +15.7%)

- FTSE 100 +3.92% (YTD +18.9%)

European markets posted moderate gains amid falling yields and improving survey data. Eurozone inflation eased to 2.1% YoY, its lowest since early 2023, while GDP grew a better-than-expected 0.2% q/q. In the U.K., the Bank of England struck a dovish tone after inflation printed unchanged at 3.8%, lifting rate-cut expectations into early 2026.

Outlook:

Europe’s macro backdrop is gradually improving, but political uncertainty in France and weak manufacturing momentum suggest near-term upside will be moderate. Dividend yield and valuation support remain compelling.

Japan: Record Highs on Policy Continuity

Equity Performance:

- Nikkei 225 +16.64% (YTD +31.4%)

Japanese equities surged to multi-decade highs after Sanae Takaichi was elected the country’s first female prime minister, pledging continued fiscal stimulus and a focus on industrial competitiveness. A weaker yen boosted exporters, and robust machinery orders underscored economic resilience. Inflation remained above 3%, pushing 10-year JGB yields to 1.66%, the highest since 2008.

Outlook:

Strong earnings revisions, corporate reforms, and policy support should sustain momentum, although the BoJ’s eventual policy normalisation remains a watch point.

China: Trade Relief Offsets Domestic Weakness

Equity Performance:

- Shanghai Composite +1.85% (YTD +18.0%)

- Hang Seng: -3.53% (YTD +29.15%)

China’s markets were mixed: offshore tech and industrial names benefited from the U.S.–China trade truce, while onshore sentiment lagged due to weak property and consumption data. Q3 GDP expanded 4.8% YoY, slightly slower than Q2’s 5.2%, but industrial output and exports remained firm.

Outlook:

Macro policy remains supportive, and the trade détente should stabilise exports, but confidence in household spending and housing markets must improve for a sustained re-rating.

South Africa: Financials and Property Shine as Resources Pause

Equity Performance:

- JSE All-Share +1.21% (YTD +29.9%)

- Resource 10 −5.45% (YTD +104.8%)

- Industrial 25 +1.52% (YTD +21.6%)

- Financial 15 +7.25% (YTD +10.2%)

- SA Listed Property +8.57% (YTD +21.9%)

October marked a leadership rotation on the JSE. After seven months of commodity-led gains, financials and property led the market higher, aided by lower bond yields and improved fiscal sentiment. South Africa’s removal from the FATF grey list supported capital flows and boosted confidence. The rand was little changed at R17.31/USD, while the 10-year bond yield eased 29 bps to 8.87%.

Inflation edged up to 3.4% YoY but remained well within target. SARB Governor Kganyago reaffirmed his commitment to lowering the inflation target to 3%, aligning long-term objectives with global peers.

Outlook:

While resources have been the clear YTD winners, the domestic rally in financials and property underscores the benefits of sector diversification. Fiscal alignment and lower yields create a constructive environment for local assets heading into year-end.

Currencies and Commodities: Dollar Mixed, Gold Firm, Oil Soft

The U.S. dollar traded mixed as investors recalibrated rate-cut expectations. The rand held steady against the greenback but strengthened on European crosses. Gold consolidated near $4,000/oz after brief profit-taking from record highs, while Brent crude softened to around $65/bbl on easing supply concerns. Platinum group metals remained firm year-to-date, supported by tight supply and resilient auto demand.

Fixed Income: Yields Drift Lower on Disinflation Trend

Fixed Income – 10-Year Benchmark Yields:

- United States: 4.08% (−0.07% MoM | −0.50% YTD)

- United Kingdom: 4.41% (−0.29% MoM | −0.16% YTD)

- Germany: 2.64% (−0.07% MoM | +0.28% YTD)

- Japan: 1.66% (+0.02% MoM | +0.57% YTD)

- South Africa: 8.87% (−0.29% MoM | −1.46% YTD)

Global bonds gained as moderating inflation encouraged rate-cut expectations across most major economies. The U.K. led developed-market performance with a 30 bps drop in gilt yields, while eurozone bonds rallied on stabilising growth data. Japan remained the outlier, with yields edging higher amid speculation of further BoJ normalisation.

South African bonds outperformed, buoyed by strong real yields, rand stability, and renewed foreign inflows.

Final Thoughts: Constructive but Selective into Year-End

October reinforced the theme of gradual normalisation and leadership rotation. Global equities continue to benefit from earnings resilience, while bonds and currencies reflect a measured shift toward easing. Japan’s breakout and South Africa’s domestic-sector rebound both highlight opportunities beyond the U.S. megacap trade.

What this means for portfolios:

- Maintain a diversified global allocation, balancing U.S. strength with opportunities in Japan, Europe, and select EMs.

- Within equities, blend growth and quality income exposures to navigate stretched valuations.

- Keep alternatives and real assets as portfolio hedges against policy and geopolitical uncertainty.

- Locally, maintain exposure to financials and property, while trimming marginal resource overweight after an exceptional run.