In this Edition:

US Markets Weaken as AI Rally Cools

U.S. equities weakened as investors reassessed AI valuations amid the ongoing government shutdown.

Europe Holds Steady as Central Banks Pause

The Bank of England, Riksbank, and Norges Bank held rates steady as European markets softened.

Asia Mixed as Japan Retreats and China Gains

Japanese markets fell while Chinese equities advanced after a truce in the US-China trade dispute.

Gold Shines as Safe-Haven Demand Strengthens

Gold prices climbed above $4,000/oz amid a weaker dollar and trade uncertainty.

South Africa Looks Ahead to the Medium-Term Budget

Markets focus on the upcoming MTBPS amid improving fiscal sentiment and stronger revenue collection.

Market Moves and Chart of the Week

US Markets Weaken as AI Rally Cools

U.S. equities lost ground last week as investors reassessed elevated valuations in the AI sector and booked profits amid a lack of fresh government data due to the ongoing federal shutdown, now in its second month.

Private sector reports provided mixed signals on the labour market. ADP data showed a modest rebound with 42,000 jobs added in October, while Challenger, Gray & Christmas reported over 150,000 job cuts, the largest October reduction in more than two decades.

Consumer confidence also deteriorated. The University of Michigan’s Consumer Sentiment Index fell sharply to 50.3, its lowest since mid-2022, with the prolonged shutdown cited as a key concern. Meanwhile, the ISM Services PMI climbed back into expansion at 52.4, while ISM Manufacturing fell further to 48.7, marking eight straight months of contraction.

All three major US indices ended last week in the red. The Nasdaq dropped around 3%, while the S&P 500 and Dow Jones each fell more than 1%, as concerns over high-tech valuations and market concentration persisted.

Europe Holds Steady as Central Banks Pause

The Bank of England kept its policy rate steady at 4.0% in a narrow 5-4 vote, hinting that market expectations for gradual rate cuts toward 3.5% over the next three years remain reasonable. UK equities held up relatively well, with the FTSE 100 easing 0.35% amid broader European weakness.

Across the continent, both Sweden’s Riksbank and Norway’s Norges Bank left rates unchanged at 1.75% and 4.0%, respectively. The Euro STOXX 50 slid 1.69% as investors questioned stretched AI-linked stock valuations and digested a third consecutive monthly decline in retail sales.

Asia Mixed as Japan Retreats and China Gains

After hitting record highs in late October, Japanese equities pulled back, with the Nikkei 225 losing 4.07% for last week amid renewed safe-haven demand and concerns over expensive AI shares.

In contrast, Chinese markets advanced following a one-year truce in the US-China trade dispute after the two presidents met at the APEC Summit in South Korea. The Shanghai Composite rose 1.08%, while Hong Kong’s Hang Seng Index gained 1.06%.

Gold Shines as Safe-Haven Demand Strengthens

Gold prices climbed above $4,000/oz by Friday’s close, supported by a weaker US dollar and heightened demand for safety amid the ongoing US government shutdown and continued trade uncertainty.

In the week ahead, markets will continue to monitor the historic US government shutdown, which has disrupted key data releases. In Europe, attention turns to UK GDP and labour market figures, while in Asia, focus will be on China’s industrial production, retail sales, property prices, and credit data for signs of economic momentum.

South Africa Looks Ahead to the Medium-Term Budget

Locally, markets will turn their focus this week to the National Treasury’s 2025 Medium-Term Budget Policy Statement (MTBPS), set to be delivered by Finance Minister Enoch Godongwana on 12 November 2025. Economists are hopeful that the delayed budget will outline progress on key structural reforms aimed at boosting growth and stabilizing public finances.

Analysts expect a slightly improved fiscal outlook, supported by better-than-expected revenue collection and ongoing efforts to rein in expenditure. South Africa has also benefited from several supportive tailwinds, including stronger gold prices-buoyed by global concerns over the US dollar’s reserve status-and increased export earnings. In addition, the country’s recent removal from the FATF grey list has lifted investor sentiment and could help attract renewed foreign capital inflows.

The rand recovered from midweek weakness, trading near R17.34/USD on Thursday and holding around R17.29 into Friday’s close, supported by steadier global risk appetite and firmer precious metal prices.

Local government bonds mirrored the improvement, with the benchmark R2035 yield easing to around 8.87%, reflecting a modest bid for duration ahead of the budget announcement.

South African equities softened in line with global markets, as a tech-led pullback weighed on sentiment. The JSE All Share Index declined 0.36% for the week, with all three major sectors-financials, industrials, and resources-ending lower.

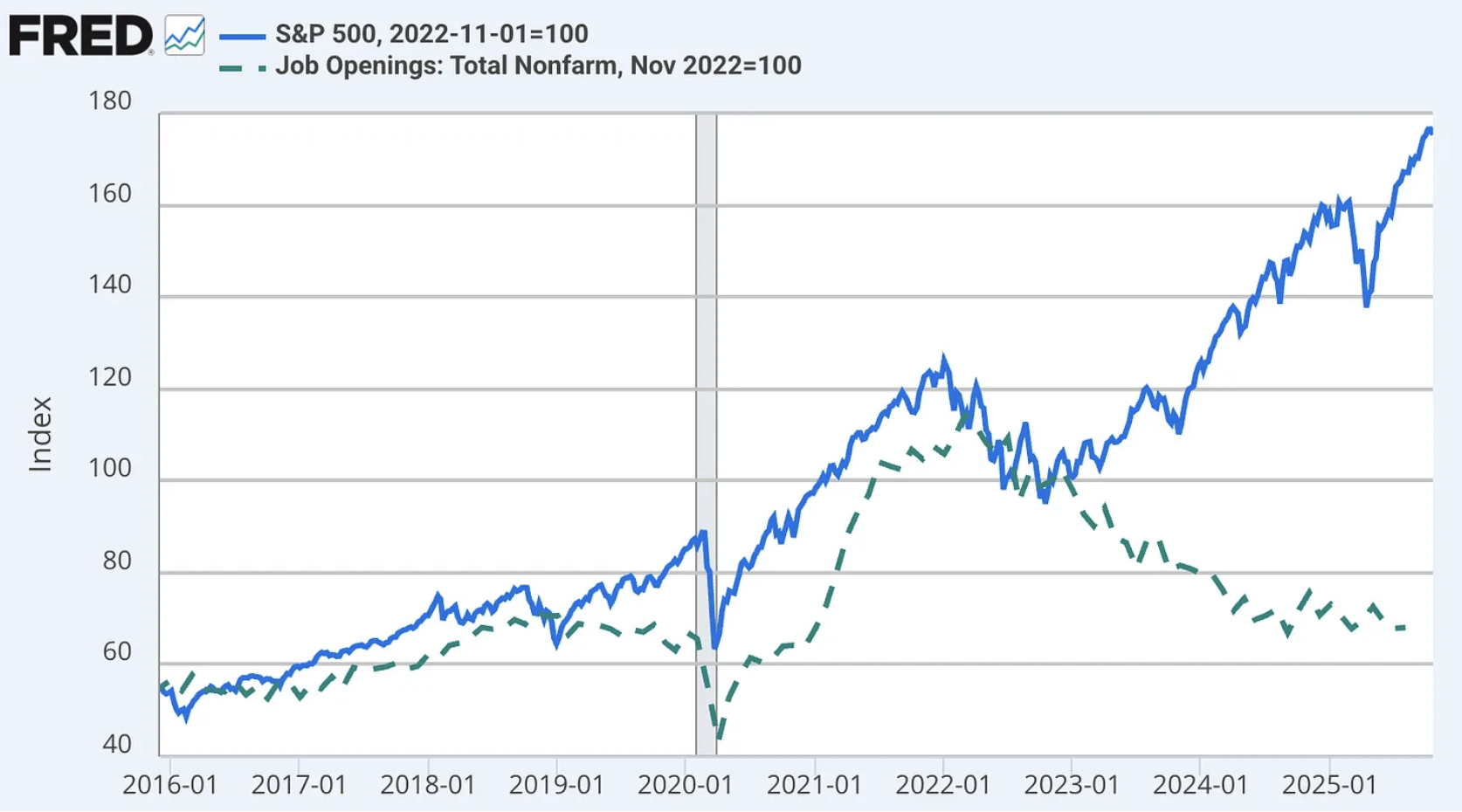

Chart of the Week

Since late 2022, the S&P 500 has continued rising even as US job openings (JOLTS) have steadily declined. This divergence began around the launch of ChatGPT, highlighting how companies-especially in white-collar sectors-became more selective in hiring while investors priced in AI-driven efficiency gains and the strength of large-cap firms.

The Fed’s rate hikes since March 2022 further cooled labour demand, deepening the split often described as a “K-shaped economy”: large, capital-rich corporations and investors thrive at the top, while smaller firms and workers face weaker demand and tighter financial conditions. The outcome-a strong stock market alongside a cooling jobs market-illustrates a recovery that’s booming on Wall Street but uneven on Main Street.