In this Edition:

Fed Rate Cut And Trade Truce Buoy Markets And Earnings

The Fed cut 25 basis points to 3.75%–4.00%, while a one-year U.S.-China trade truce and more than 80% of S&P 500 companies beating estimates lifted sentiment, with the S&P 500 and Nasdaq setting new highs.

ECB Holds as Growth Shows Signs of Stabilising

The ECB kept rates at 2.15% as eurozone GDP rose 0.2% in Q3 and improving German sentiment offset concerns, while UK housing indicators edged up.

Japan Rallies to Records as China Softens

Japan’s Nikkei 225 posted a 16.6% monthly gain amid steady BoJ policy and tech optimism, whereas China’s manufacturing PMI slipped to 49.0 and stimulus remained limited.

Global Risk Assets Supported by Earnings And Rate-Cut Hopes

Global equities mostly advanced (Dow +0.75%, S&P 500 +0.71%, Nasdaq +2.24%) as bond yields were mixed and gold and oil eased, reflecting balanced risk appetite.

SARB Reiterates 3% Target as Policy Alignment Improves

Governor Kganyago reaffirmed plans to lower the inflation target to 3% and highlighted Treasury coordination ahead of 12 November, with local markets mixed and the rand slightly weaker.

Market Moves and Chart of the Week

Fed Rate Cut And Trade Truce Buoy Markets And Earnings

Global markets ended October near record highs, shrugging off earlier volatility as investors drew confidence from strong corporate earnings, progress in U.S.-China trade discussions, and growing expectations that interest rates have peaked. Technology shares continued to lead performance, while concerns around the U.S. government shutdown and political wrangling in Washington had limited market impact.

The U.S. Federal Reserve delivered a widely expected 25 basis-point rate cut, lowering the benchmark rate to 3.75%–4.00%. Chair Jerome Powell emphasised that another cut in December is “not a foregone conclusion,” noting divisions among policymakers and data disruptions caused by the ongoing shutdown. The Fed’s message reflected a more balanced stance – acknowledging easing inflation and softer labour conditions but avoiding premature stimulus. Meanwhile, a one-year trade truce between Presidents Trump and Xi helped ease tensions, with the U.S. scaling back select tariffs and China pledging to resume agricultural imports. Despite temporary growth drags from the shutdown, private-sector data continues to show steady consumer spending and resilient employment trends.

Corporate earnings also provided reassurance, with over 80% of S&P 500 companies beating expectations, underscoring the strength of underlying business fundamentals. While results from mega-cap technology firms were mixed, enthusiasm around artificial intelligence and improving productivity trends continued to drive market gains. The Nasdaq and S&P 500 both reached new highs, reflecting confidence that profit growth remains robust heading into year-end.

ECB holds as growth shows signs of stabilising

In Europe, the European Central Bank held interest rates steady at 2.15% as inflation hovered near its 2% target. President Christine Lagarde reiterated that decisions will remain data-dependent, pointing to signs of stabilisation in the eurozone economy. GDP expanded by 0.2% in the third quarter – slightly above expectations – driven by France and Spain, while the unemployment rate held firm at 6.3%. In the UK, house prices and mortgage approvals improved modestly, hinting at a stabilising housing market. In Germany, sentiment and business confidence picked up, suggesting the industrial slowdown may be bottoming out.

Japan rallies to records as China softens

Across Asia, Japanese equities rallied to a record high, with the Nikkei 225 gaining 16.6% – its best monthly gain since 1994 – on steady policy support and optimism around global technology earnings. The yen weakened slightly after the Bank of Japan left rates unchanged and signalled patience on future hikes. In China, markets were more subdued as optimism over trade progress was offset by a lack of new policy stimulus. The manufacturing PMI slipped to 49.0, pointing to mild contraction, while authorities reaffirmed their goal of shifting growth toward domestic demand.

Global risk assets supported by earnings and rate-cut hopes

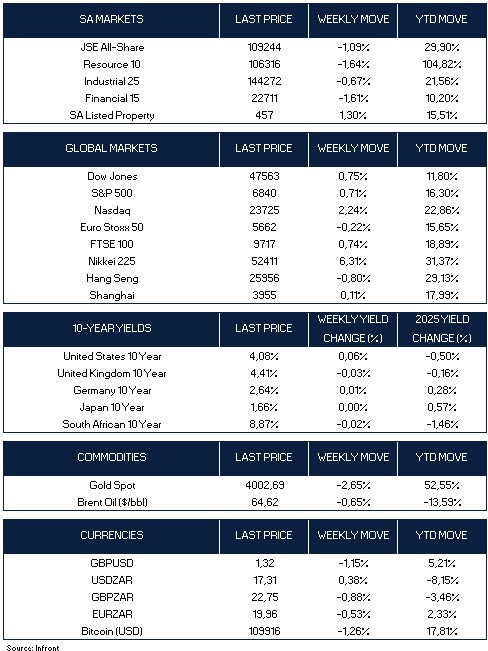

Global markets ended last week largely higher, supported by strong corporate earnings and renewed optimism around U.S. rate cuts. In the U.S., the Dow Jones gained 0.75%, the S&P 500 rose 0.71%, and the Nasdaq advanced 2.24% as technology shares outperformed. In Europe, performance was more muted, with the Euro Stoxx 50 slipping 0.22% and the FTSE 100 adding 0.74%. In Asia, Japan’s Nikkei 225 surged 6.31%, leading global gains, while Hong Kong’s Hang Seng fell 0.80% and the Shanghai Composite edged up 0.11%. Bond yields were mixed – U.S. 10-year yields rose slightly to 4.08%, while UK and German yields were marginally softer. Gold pulled back 2.65% after recent highs, Brent crude fell 0.65%, and Bitcoin retreated 1.26%, though it remains up 17.8% year-to-date.

SARB reiterates 3% target as policy alignment improves

South African Reserve Bank Governor Lesetja Kganyago reaffirmed his commitment to lowering the inflation target to 3%, arguing that persistent pressures from administered prices and multi-year wage agreements should not delay the transition. He stressed that while electricity and water tariffs remain elevated, policy credibility depends on setting long-term goals aligned with international peers rather than waiting for temporary distortions to subside.

The central bank has long maintained that the current 3-6% inflation band is uncompetitive, and although Finance Minister Enoch Godongwana has not yet formally endorsed the change, the SARB has been guiding expectations toward the lower end of the range. Critics suggest the central bank is moving ahead of Treasury, but Kganyago highlighted falling government bond yields – down 80–160 basis points since April – as evidence of continued investor confidence.

He also emphasised alignment between fiscal and monetary authorities, noting close coordination with Treasury ahead of the Medium-Term Budget Policy Statement on 12 November, where a formal adoption of the new target could be confirmed. Meanwhile, National Treasury reported a R15.36 billion budget deficit for September, suggesting the current account shortfall widened modestly from 1.1% of GDP in Q2 to 1.6% in Q3, while producer inflation eased to 2.3% year-on-year, indicating softer upstream price pressures. Locally, the JSE All Share Index fell 1.09%, dragged lower by resources (-1.64%), industrials (-0.67%), and financials (-1.61%), while listed property advanced 1.30% to cap a resilient performance for the sector. The rand weakened slightly by 0.38% to R17.31/$, while the 10-year government bond yield eased marginally to 8.87%.

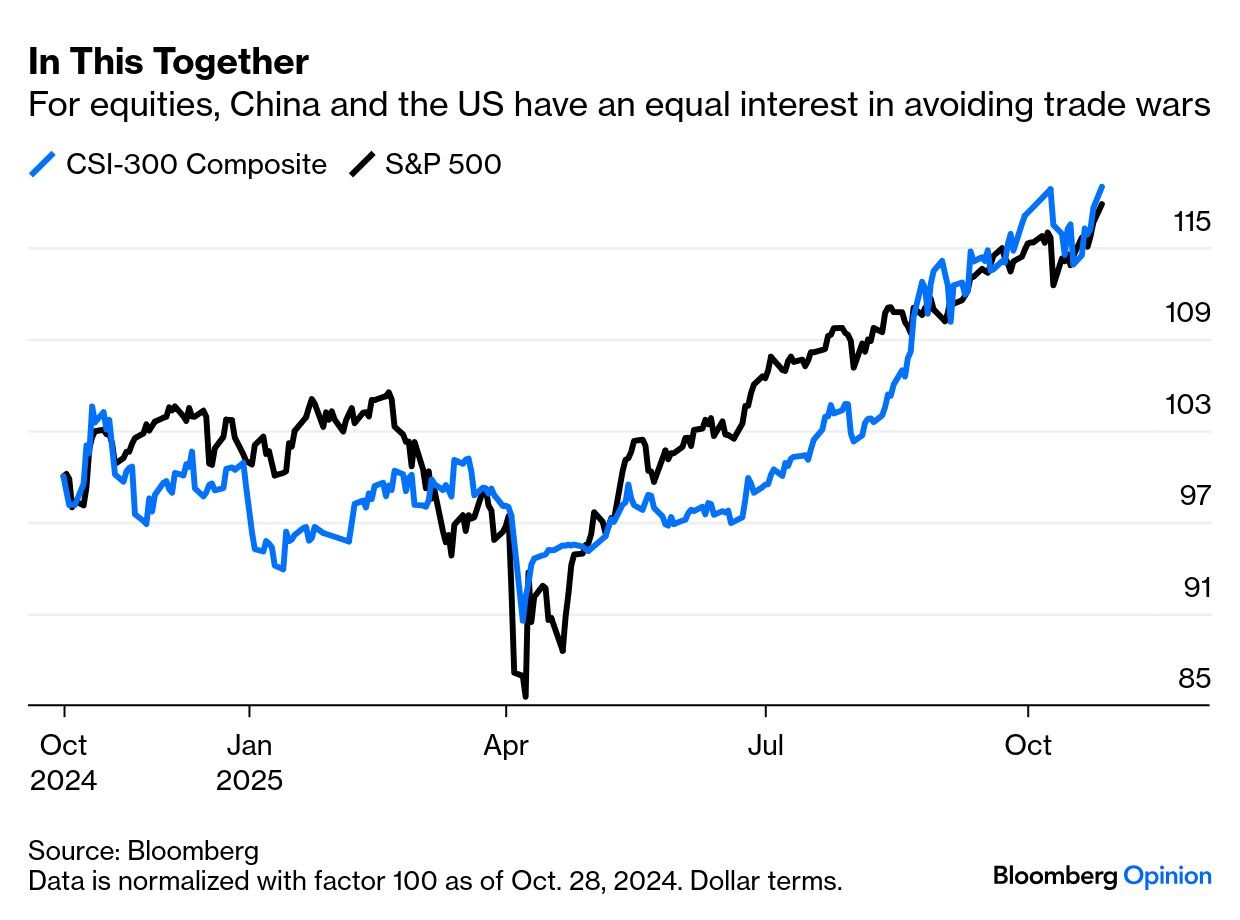

Chart of the Week

Global equities started the week on a strong note, with the S&P 500 and Nikkei 225 reaching record highs—the latter topping 50,000 for the first time. Gains were broad-based across major indices, fuelled by optimism after reports of progress in U.S.–China trade talks in Kuala Lumpur. The prospect of easing trade tensions drove renewed risk appetite and pulled investors away from defensive assets such as gold, which has slipped below $4,000/oz. The chart illustrates how closely U.S. and Chinese equities have moved in tandem this year, underscoring the deep link between global sentiment and the stability of their trade relationship. Source: Bloomberg