In this Edition:

Inflation Steady, Growth Momentum Builds Amid Renewed Sanctions on Russia US inflation held at 3% in September while business activity strengthened, reinforcing expectations of Fed rate cuts as Washington imposed new sanctions on Russian oil giants, signalling renewed transatlantic unity.

Inflation Eases and Growth Rebounds UK inflation remained steady at 3.8% while Eurozone PMI hit a 17-month high on rising new orders, though France’s economy continued to contract.

China Growth Slows, Japan Rallies on Political Shift China’s economy grew 4.8% in Q3 with industrial output strength offset by weak consumption, while Japan’s Nikkei surged after pro-growth leadership took office.

Inflation Ticks Up and Grey-Listing Ends South African inflation rose slightly to 3.4%, and the country’s removal from the FATF grey list boosted investor confidence despite mixed market performance.

Equities Advance Despite Geopolitical Volatility Global equities gained across major regions, led by U.S. tech stocks and Asian markets, even as oil prices climbed following U.S. sanctions on Russia.

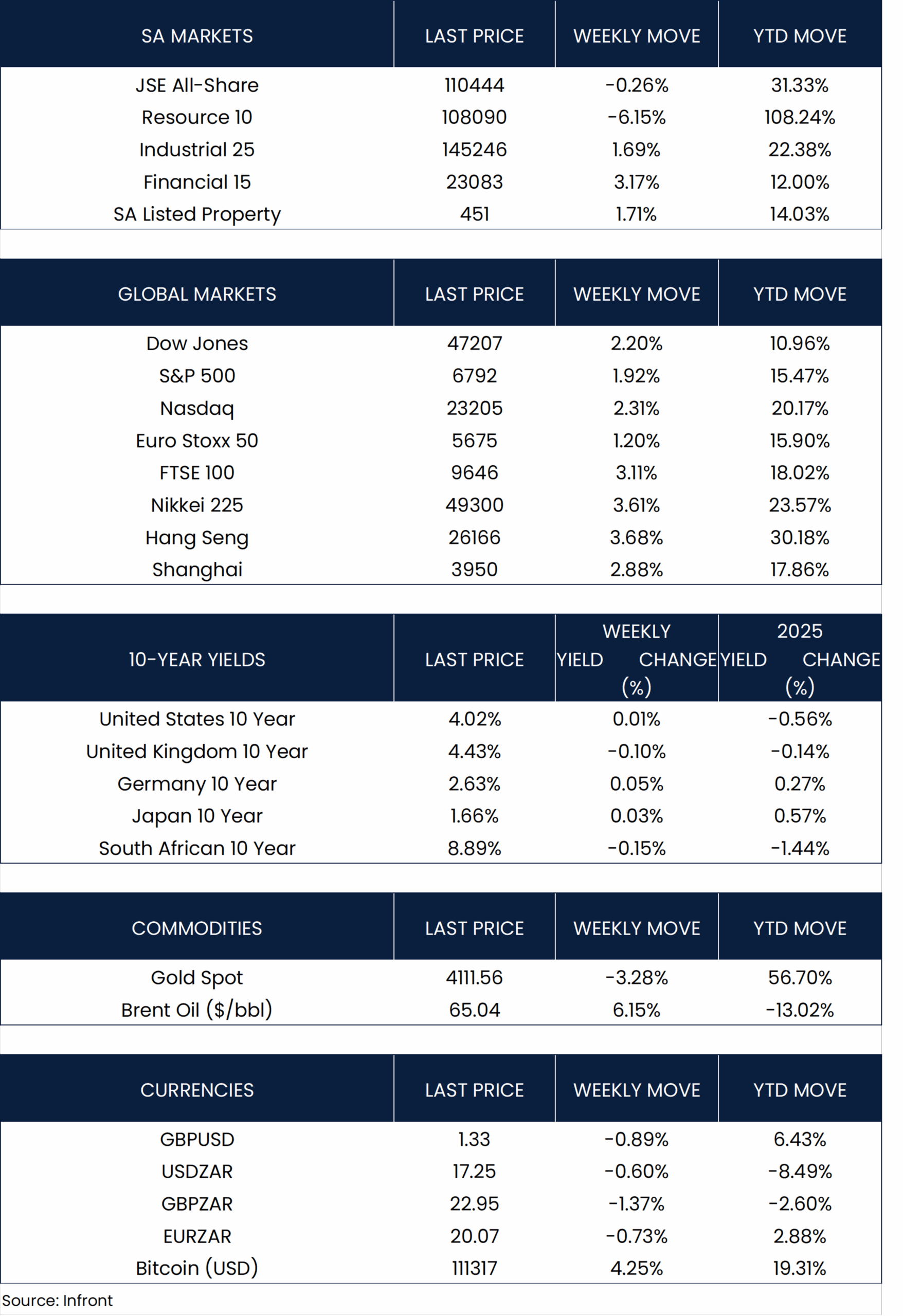

Market Moves and Chart of the Week

Inflation Steady, Growth Momentum Builds Amid Renewed Sanctions on Russia

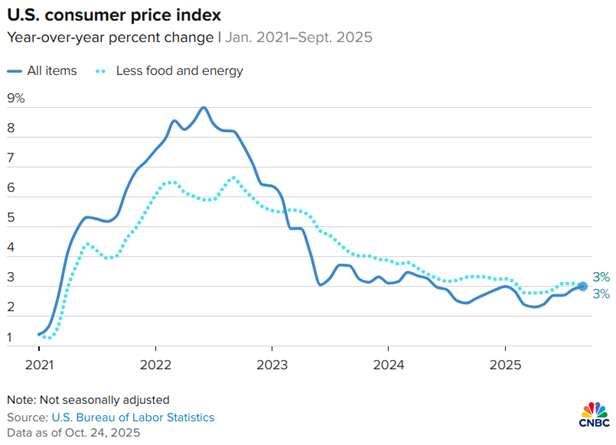

US consumer prices increased modestly in September, with headline CPI rising 0.3% month-on-month, taking the annual rate to 3%. Core CPI, which excludes food and energy, rose 0.2% on the month, keeping the annual rate at 3%. The release came later than scheduled due to the US government shutdown, which has disrupted several economic data series, though the CPI update was prioritised to enable calculation of the Social Security cost-of-living adjustment.

An early reading of the S&P Global purchasing managers’ indexes indicated that US business activity continued to strengthen in October, with the composite PMI rising to 54.8 from 53.9 in September – the 33rd consecutive month in expansionary territory. Services continued to lead the improvement, reaching a three-month high of 55.2, while the manufacturing PMI edged up to 52.2 from 52.0. However, sentiment among manufacturers softened, with optimism slipping to its second-lowest level since June 2024 amid ongoing concerns around tariffs and policy uncertainty.

On Wednesday evening, the US imposed sanctions on Russian oil majors Lukoil and Rosneft. The move represents a rare alignment between Washington and Europe in pressuring Moscow since the start of the current Trump administration. Following the Kremlin’s rejection of US peace talks, major Indian and Chinese refiners are expected to sharply cut Russian imports, adding further strain to the Russian economy.

Inflation Eases and Growth Rebounds

Headline annual inflation in the UK unexpectedly held steady at 3.8% for the third consecutive month, coming in below forecasts. Core inflation, which excludes volatile items to gauge underlying price pressures, eased to 3.5% from 3.6% in August. In response, financial markets have markedly raised expectations for an interest rate cut in December.

Eurozone business activity reached a 17-month high in October, underpinned by the strongest rise in new orders in over two years. S&P Global’s provisional, seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index climbed to 52.2 from 51.2 in September, surpassing consensus expectations. Services activity rose to a 14-month high of 52.6, while manufacturing expanded for the eighth consecutive month, edging up to 50.0 from 49.8, supported by robust output in Germany. In contrast, business activity in France continued to contract for the 14th straight month, recording the fastest pace of decline since February.

China Growth Slows, Japan Rallies on Political Shift

China’s economy expanded 4.8% year-on-year in the third quarter, providing a “solid foundation” for achieving the official growth target of around 5% for 2025, according to the country’s statistics bureau. Despite this, several areas showed weakness: retail sales rose just 3.0% YoY in September, the slowest pace since November, and fixed-asset investment fell 0.5% over the first nine months. Industrial output, however, beat expectations with a 6.5% YoY increase in September, supported by robust export activity.

In Asia, Japan’s Nikkei 225 jumped 3.61% as markets welcomed the election of Liberal Democratic Party leader Sanae Takaichi as prime minister, with expectations that her pro-growth fiscal policies will support equities. Mainland Chinese markets rose despite weak domestic demand, led by technology stocks, with the Shanghai Composite gaining 2.88% and Hong Kong’s Hang Seng Index up 3.62%.

Inflation Ticks Up and Grey-Listing Ends

South Africa’s annual headline inflation rose modestly to 3.4 % in September, up from 3.3 % in August, marking the second-highest reading in 2025 after the 3.5 % peak in July. According to Statistics South Africa, the increase was largely driven by higher prices in transport, as well as restaurants and accommodation. Core CPI, which excludes volatile items such as food, non-alcoholic beverages, fuel and energy, also edged higher, rising to 3.2 % year-on-year from 3.1 % in August.

South Africa has been removed from the Financial Action Task Force’s (FATF) “grey list,” ending more than two years of increased international scrutiny over illicit finance risks. Grey-listing had previously prompted heightened monitoring of transactions by global banks, which the IMF noted had a significant dampening effect on capital flows. The original designation in early 2023 followed gaps in intelligence collection, coordination on financial crimes, and prosecution efforts. The delisting is expected to ease pressures on the financial sector and improve investor confidence, though continued vigilance remains necessary to sustain compliance.

Unlike its global peers, the JSE All-Share Index ended last week 0.26% lower, weighed down by a 6.10% decline in the resource sector. Other sectors performed positively, led by financials, which rose 3.17%, followed by property (+1.71%) and industrials (+1.6%). By Friday’s close, the rand strengthened 0.60% against the U.S. dollar, trading at R17.25.

Equities Advance Despite Geopolitical Volatility

Global equities advanced over last week, shrugging off volatility from U.S.-China trade headlines and a spike in oil prices following U.S. sanctions on Russia’s two largest oil companies. In the U.S., the Nasdaq Composite led gains, rising 2.31%, while the Dow Jones and S&P 500 increased 2.20% and 1.92%, respectively.

European markets also recorded solid gains, with the STOXX Europe 50 up 1.20% and the UK’s FTSE 100 climbing 3.11%.