In this Edition:

Markets Rise as Trade Tensions Ease and Fed Signals Support

U.S. equities ended the week higher as easing trade tensions with China, dovish Federal Reserve remarks, and optimism in the AI sector offset renewed volatility from regional banking stress and an ongoing government shutdown.

Gains Supported by Global Sentiment but UK Data Soft

European markets advanced on improved global risk sentiment and Powell’s dovish tone, though UK equities lagged amid weak GDP growth and slightly higher unemployment.

Mixed Performance Amid Deflationary Pressures and Trade Uncertainty

Asian markets declined as Japan’s stronger yen weighed on exporters and China’s deeper-than-expected deflation data dampened sentiment, despite signs of firmer core inflation and resilient domestic demand.

Gold Retreats and Oil Faces Continued Supply Pressure

Gold prices fell over 2% from record highs as easing U.S.–China trade tensions curbed safe-haven demand, while Brent crude recorded a third straight weekly decline amid rising inventories and oversupply concerns.

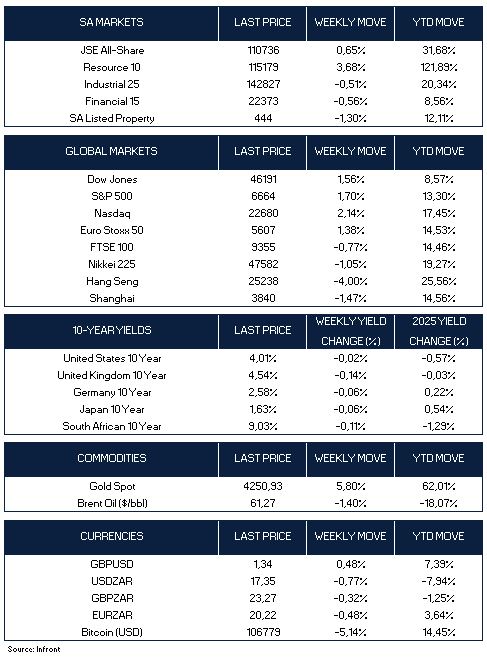

Market Moves and Chart of the Week

Markets Rise as Trade Tensions Ease and Fed Signals Support

The Dow Jones Industrial Average advanced on Friday as investors reacted to a softer tone from U.S. officials regarding trade negotiations with China and looked past renewed concerns in the regional banking sector. Despite midweek volatility, all three major U.S. indices closed last week higher; the S&P 500 rose 1.7%, the Dow gained 1.6%, and the Nasdaq advanced 2.1%.

Early optimism followed signs of easing trade tensions between Washington and Beijing, supported by dovish commentary from several Federal Reserve officials and continued deal activity within the artificial intelligence (AI) sector. Treasury Secretary Scott Bessent confirmed plans to speak with his Chinese counterpart, while President Trump noted that a meeting with President Xi Jinping remained likely later this month, comments that helped ease fears of new tariffs due on November 1.

However, Thursday saw renewed volatility as the Dow fell 300 points and the S&P 500 declined 0.6%, dragged lower by regional banks. The SPDR S&P Regional Banking ETF (KRE) dropped over 6%, marking its fourth consecutive weekly loss. Investor anxiety grew following the bankruptcies of auto-industry-linked lenders Tricolor and First Brands, coupled with allegations of loan-related fraud at two regional banks. The turmoil briefly drove the Cboe Volatility Index (VIX) to its highest level since April before easing on Friday.

Fed Chair Jerome Powell reiterated that downside risks to employment have increased, reinforcing expectations of another rate cut this year. Additional dovish remarks from policymakers Christopher Waller and Stephen Miran strengthened the view that the Fed remains committed to supporting growth despite inflation remaining above target.

U.S. Treasury yields declined across the curve, with the 10-year yield falling to its lowest level since October 2024. Safe-haven demand was further supported by ongoing concerns over the federal government shutdown, now entering its third week, with little progress in negotiations between parties.

Gains Supported by Global Sentiment but UK Data Soft

In Europe, the STOXX Europe 50 Index gained 1.38%, buoyed by Powell’s dovish tone and easing U.S.–China trade tensions. The UK’s FTSE 100 declined 0.77%, despite data showing that GDP grew 0.1% in August, following a 0.1% contraction in July. The unemployment rate edged up slightly to 4.8%, indicating a modest loosening in labour market conditions.

Mixed Performance Amid Deflationary Pressures and Trade Uncertainty

In Asia, Japan’s Nikkei 225 fell 1.05% as yen strength weighed on exporters and investor sentiment remained cautious amid global trade uncertainty, while in China, deflationary pressures persisted. Producer prices fell 2.3% year-on-year in September, while consumer prices declined 0.3%, deeper than expected. However, core inflation rose to a 19-month high of 1.0%, offering a glimmer of resilience in domestic demand. The Shanghai Composite Index fell 1.47% for last week, while Hong Kong’s Hang Seng Index dropped 4%, pressured by escalating trade concerns and weak property sentiment.

Gold Retreats and Oil Faces Continued Supply Pressure

Gold fell over 2% on Friday to around $4,250 per ounce, retreating from record highs as easing U.S.–China trade tensions tempered safe-haven demand. Despite the pullback, the metal remains up more than 60% year to date, supported by expectations of U.S. rate cuts, geopolitical risks, and strong central bank and ETF demand.

Meanwhile, Brent crude rose 0.4% on Friday to just under $61.30 per barrel, though it recorded a third straight weekly decline amid oversupply concerns. Rising U.S. inventories and an IEA forecast of a global crude surplus in 2026 continued to weigh on sentiment.

The next week, markets will focus on developments in the U.S.–China trade dialogue, the ongoing government shutdown, and a range of key economic releases, including the U.S. CPI, PMI, and existing home sales reports. In Asia, attention will turn to China’s Q3 GDP and other key data points, while in Europe, investors will watch Euro Area consumer confidence and UK inflation figures. Monetary policy decisions from the central banks of Turkey, Indonesia, and South Korea will also be closely monitored.

Government to Lift Shale Gas Moratorium, Markets Mixed

South Africa is set to lift its long-standing moratorium on unconventional gas exploration, including shale resources, once new regulations are gazetted later this month, according to Petroleum Resources Minister Gwede Mantashe. The move is expected to reopen investment opportunities in the Karoo Basin, which the U.S. Energy Information Administration (EIA) estimates holds up to 390 trillion cubic feet of technically recoverable shale gas. The moratorium, in place since 2011, allowed for environmental and technical assessments amid concerns over hydraulic fracturing. Mantashe said the government has finalised a structured and transparent licensing framework under the Upstream Petroleum Resources Development Bill to ensure responsible exploration.

On the markets front, the rand remained under pressure for most of Friday, ending the session at R17.35/$, after a volatile week driven by global trade developments, while the benchmark JSE All Share Index gained 0.65% for last week, after a strong sell-off in resource counters on Friday.

Investors will turn their focus to this week’s September CPI release for insight into domestic inflation trends. Headline inflation eased to 3.3% year-on-year in August from 3.5% in July. A Reuters poll forecasts a modest uptick to 3.5%.

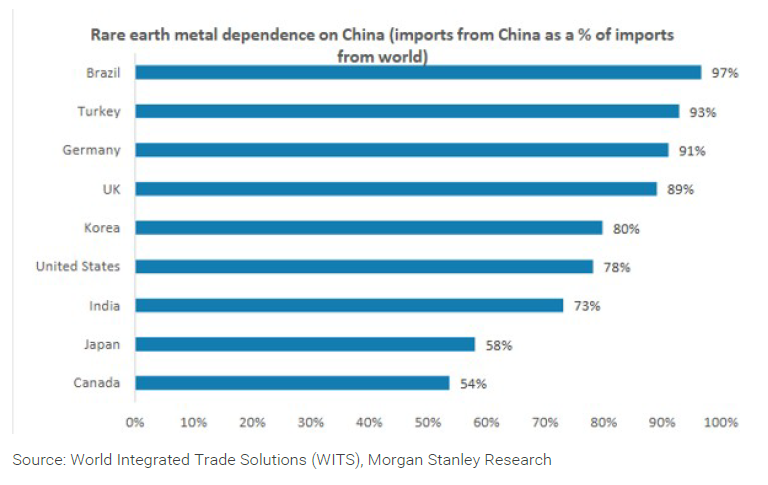

Chart of the Week

Most economies remain heavily reliant on China for rare earth metals, which are vital to a wide array of growing technologies, from batteries and smartphones to wind turbines. That’s why China’s moves the previous week to tighten curbs on these critical minerals, followed early Tuesday by new controls over companies involved in shipping them, landed as such an unwelcome surprise to the U.S.