In this Edition:

Shutdown and Trade Tensions Weigh on Markets

Renewed trade tensions and the prolonged U.S. government shutdown dampened sentiment, leading to broad market declines.

Industrial Weakness and Political Instability Pressure Outlook

Falling German production and political turmoil in France weighed on confidence, though the ECB signalled improving inflation trends.

Mixed Momentum Amid Policy and Political Shifts

Japan’s political changes spurred short-term optimism, while China’s weak Golden Week data underscored soft domestic demand.

Policy Easing Continues

Monetary authorities in New Zealand and Poland cut rates further to support slowing growth and stabilising inflation.

Policy Alignment and Fiscal Improvement Support Confidence

Government and central bank alignment on inflation targeting, stronger revenue growth, and fiscal restraint boosted the medium-term outlook.

Mixed Performance Amid Global Uncertainty

The JSE gained slightly, supported by financials and property, while the rand weakened on softer global risk sentiment.

Market Moves and Chart of the Week

Shutdown and Trade Tensions Weigh on Markets

U.S. equities weakened over last week as renewed trade tensions and the prolonged government shutdown weighed on sentiment. Markets were supported early on by strong gains in AI-related companies, highlighted by the AMD–OpenAI partnership, but later sold off after President Trump threatened large tariffs on Chinese goods. The shutdown entered its second week, delaying economic data and disrupting federal services, and while such events typically have only temporary effects, a longer duration could weigh more meaningfully on growth. At the same time, investors remained focused on the upcoming earnings season, with expectations for a ninth consecutive quarter of profit growth. Safe-haven demand increased, sending gold above $4,000/oz and U.S. Treasury yields lower. Fed minutes showed policymakers remained divided but still saw scope for rate cuts later this year.

Industrial Weakness and Political Instability Pressure Outlook

European data signalled continued weakness, led by a 4.3% drop in German industrial production in August, driven by auto sector declines and broader softness across manufacturing. Exports also fell, particularly to the U.S., prompting the German government to introduce budget cuts and electric vehicle subsidies. Political instability added pressure as the resignation of France’s prime minister triggered a selloff in French assets and higher bond yields. In the UK, house prices declined and buyer demand remained weak, although business activity stabilised slightly. The ECB noted inflation is moving closer to target and growth may recover in 2026, though sluggish exports and a stronger euro could limit near-term momentum.

Mixed Momentum Amid Policy and Political Shifts

Japanese equities rose early in the week after Sanae Takaichi secured leadership of the ruling LDP, increasing expectations for fiscal stimulus and continued loose monetary policy, which weakened the yen. However, optimism faded as coalition partner Komeito withdrew support, raising uncertainty over government formation and fuelling speculation of a snap election. The 10-year JGB yield climbed to its highest level since 2008 on expectations of additional stimulus. Economic data was mixed, with wage growth slowing but household spending and producer price inflation both remaining firm, pointing to underlying demand despite political uncertainty.

Mainland Chinese equities were mixed in a holiday-shortened week, with the Shanghai Composite edging higher and the CSI 300 slightly lower, while Hong Kong’s Hang Seng fell more than 3%. Early consumption data from Golden Week was weaker than expected, with retail and restaurant sales rising only 3.3% – about half the pace of the May Labor Day holiday – and passenger traffic growth also slowing. This highlighted the ongoing challenge of shifting the economy toward domestic demand and services. Attention is now turning to the upcoming fourth plenum on October 20–23, where policymakers are expected to outline priorities for the next five-year plan.

Policy Easing Continues

Elsewhere, global central banks continued to ease policy to support growth. The Reserve Bank of New Zealand cut interest rates by 50 basis points to 2.5%, while Poland’s central bank reduced rates by 25 basis points to 4.50% in its third cut since June, citing slowing activity and stabilising inflation.

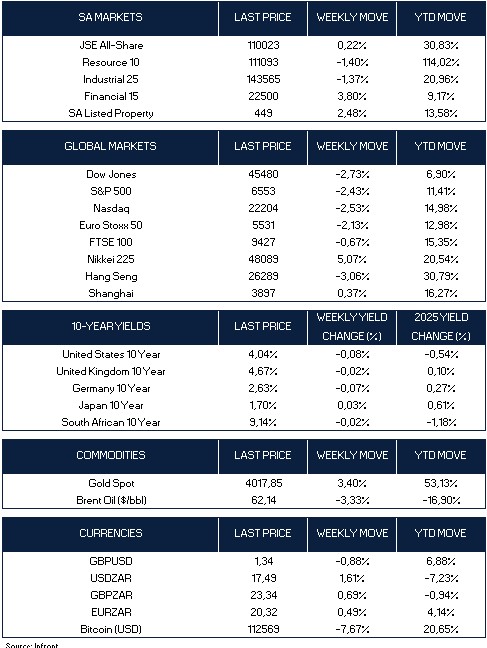

Global markets were mixed. In the U.S., the Dow fell 2.73%, the S&P 500 lost 2.43% and the Nasdaq declined 2.53%. In Europe, the Euro Stoxx 50 fell 2.13% and the FTSE 100 slipped 0.67%. In Asia, Japan’s Nikkei 225 rose 5.07%, the Shanghai Composite edged up 0.37% and Hong Kong’s Hang Seng dropped 3.06%. U.S. 10-year Treasury yields moved lower on safe-haven demand, while German and UK yields also declined slightly and Japanese yields rose. Gold strengthened and oil prices fell, while Bitcoin declined but remains higher year to date.

Policy Alignment and Fiscal Improvement Support Confidence

South African policymakers moved to clarify their stance on inflation targeting after Finance Minister Enoch Godongwana criticised Reserve Bank Governor Lesetja Kganyago for a “unilateral” statement on lowering the target. The two later issued a joint statement signalling alignment, with Kganyago emphasising that the discussion is about timing rather than direction. He noted that expectations of a lower inflation target have already strengthened the rand and reduced government borrowing costs. The fiscal outlook has also improved, with revenue up more than 10% in the first five months of the 2025/26 year and spending rising only around 4%, partly due to delayed budget approval and tighter controls on social grants. After rising from 26% of GDP in 2009 to 77% in 2025, the debt ratio is expected to stabilise before gradually declining as Treasury targets a larger primary surplus. The mid-term budget will be presented on November 12. Manufacturing output rose 0.4% month on month in August, though remained 1.5% lower year on year.

Mixed Performance Amid Global Uncertainty

South African markets were mixed over last week. The JSE All Share Index inched up 0.22%, supported by financials (+3.80%) and listed property (+2.48%). Resource stocks fell 1.40% and industrials declined 1.37%, weighing on overall gains. The rand weakened 1.61% against the U.S. dollar to R17.49 as global risk sentiment softened, while the South African 10-year government bond yield was little changed at 9.14%.

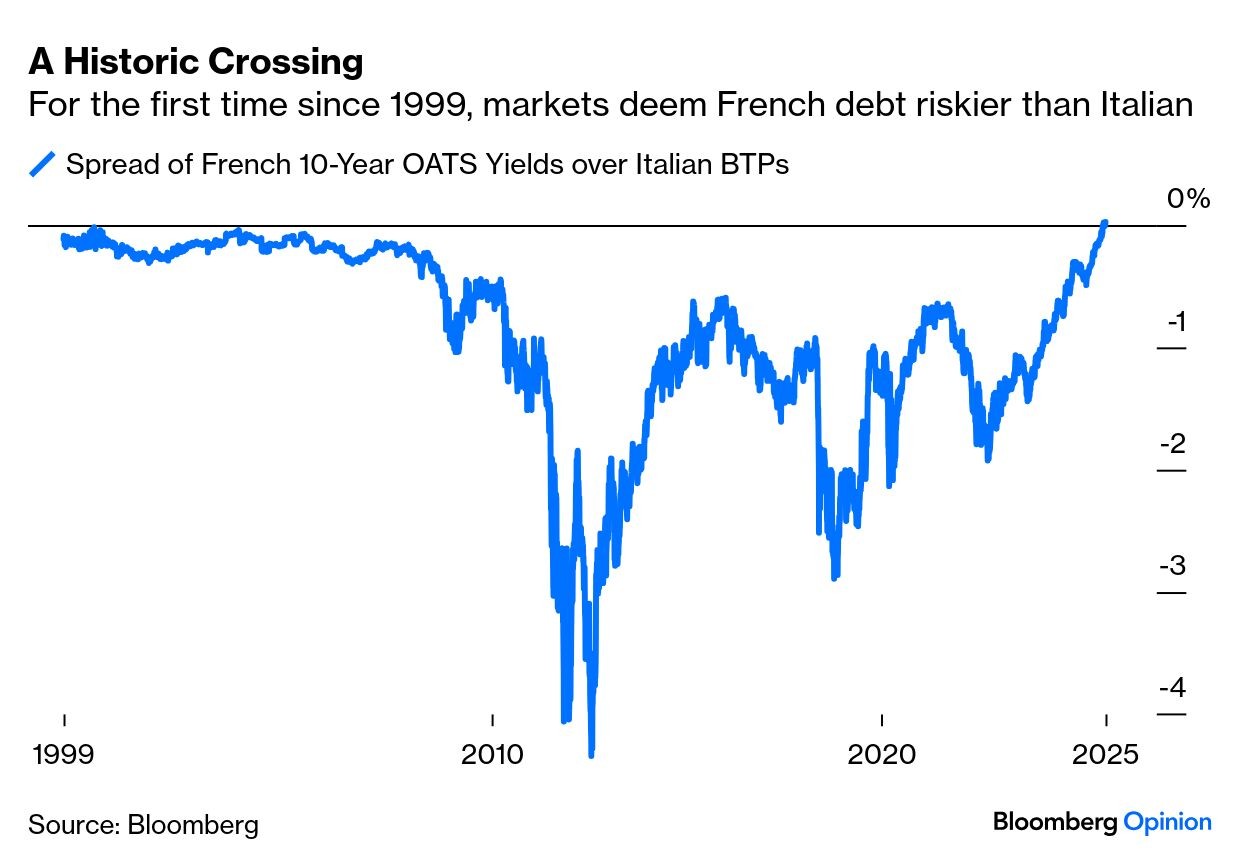

Chart of the Week

Politics doesn’t matter to markets, until it does. France’s prime minister resigned after failing to form a stable cabinet, highlighting deep divisions over how to manage the country’s heavy debt burden. With no agreement on fiscal policy, confidence in French bonds deteriorated sharply, pushing yields higher than Italian bonds for the first time since the euro’s launch in 1999. France has had five prime ministers in under two years – matching Italy’s historical total of 45 since World War II (The equivalent for the UK is 19) -underscoring escalating instability. Investors have responded by selling French assets, and despite French companies being largely global, the CAC 40 has underperformed the rest of Europe by about 14% since the start of last year. Source: Bloomberg